Use The Point Calculator to calculate credit card rewards points, miles, and cash back.

Credit Card Rewards Calculators

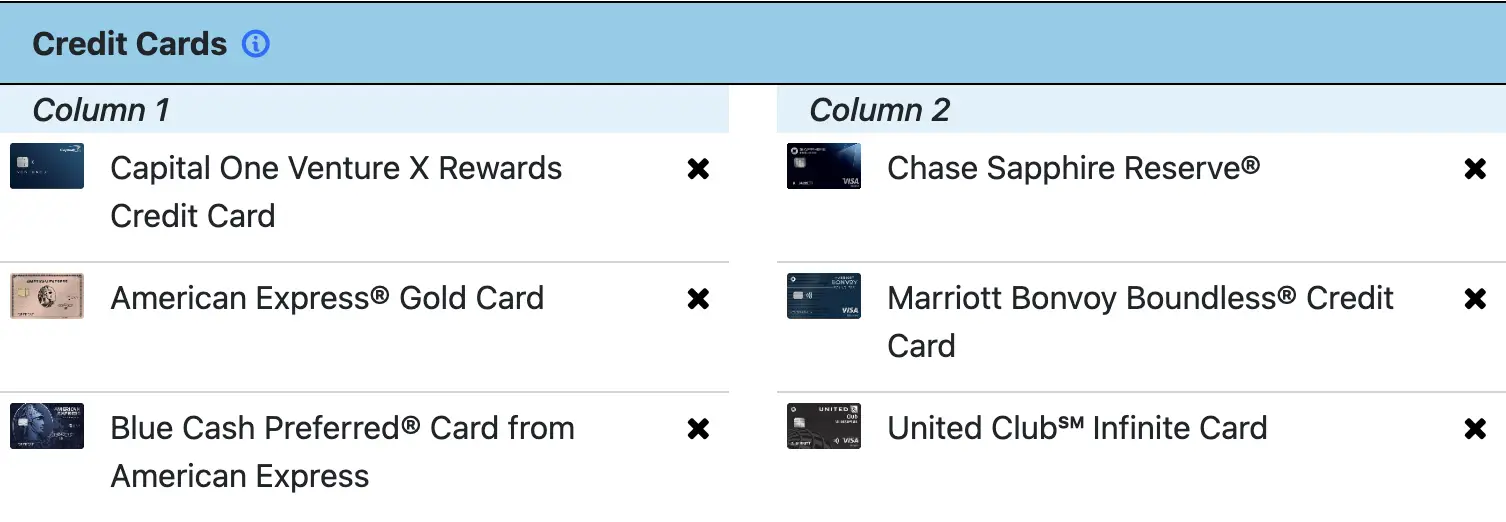

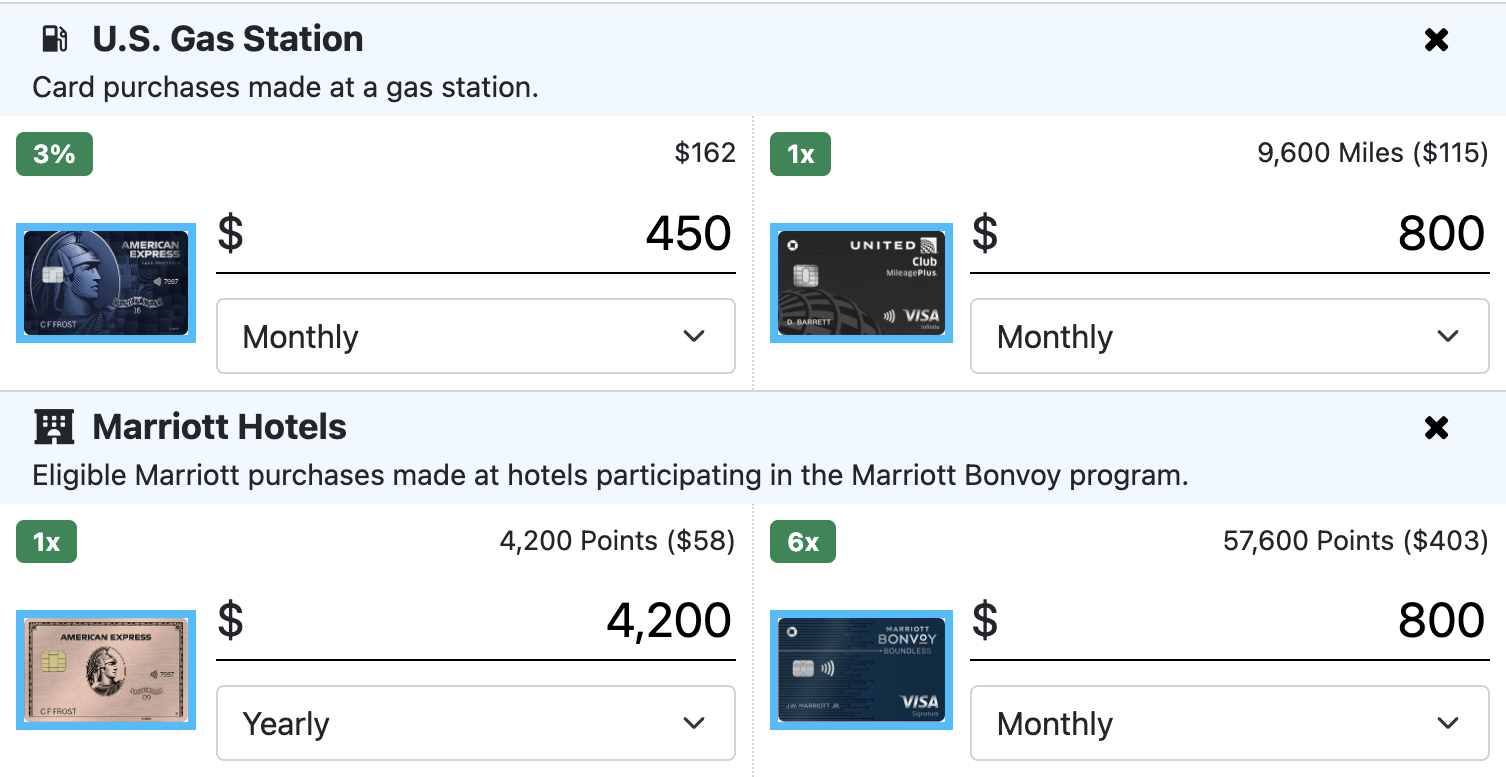

Credit Card Comparison & Rewards Calculator Tool

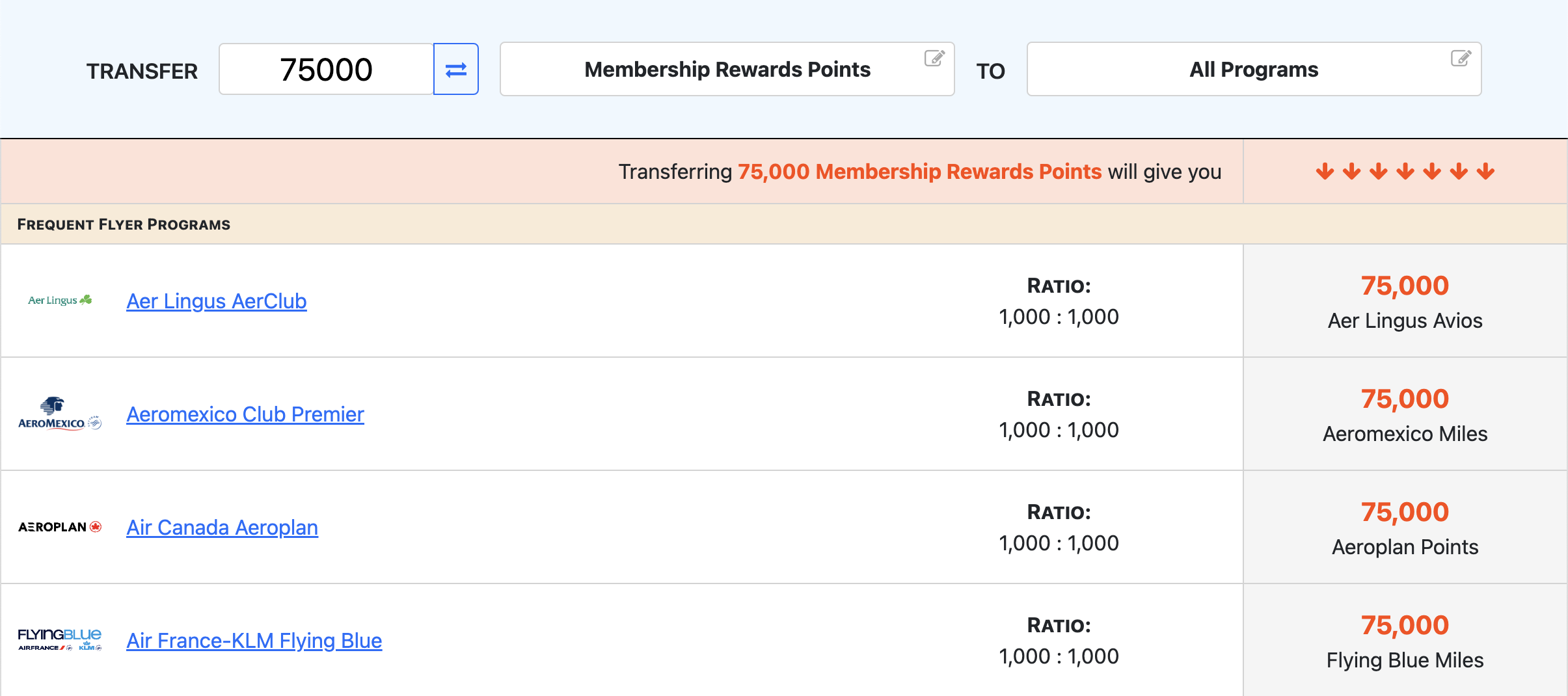

Points & Miles Transfer Partner Calculator Tool

Want to find out which programs your points and miles can be transferred to? Our Points & Miles Transfer Partner Calculator can help you with that.

Calculate the transfer of points and miles to all partner programs, a specific program, or anything in-between.

You can calculate transfers based on how many points you need with a specific program as well!

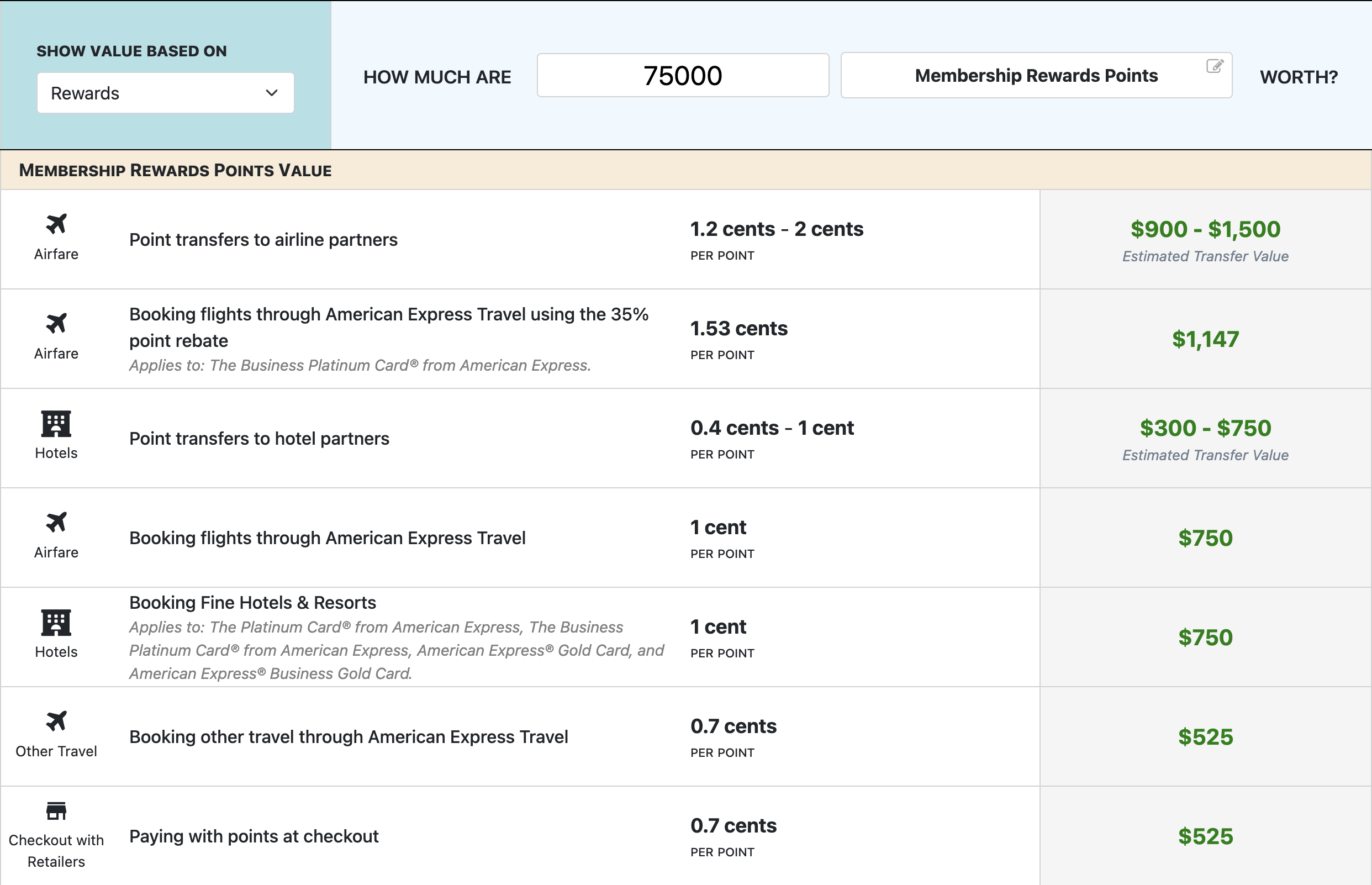

Points & Miles To Dollars Calculator

For many programs, the value of your points and miles can vary based on how you use them. This is where our tool can come in handy.

It breaks down the average values based on redemption (when applicable). That way you will know how much your rewards are worth when using them for travel versus using them for gift cards or merchandise.

Rewards Credit Card Directory & Calculator Tool

Explore our comprehensive list of U.S. credit cards, including earning rates, fees, transfer partners, perks, and the latest intro bonuses—all in one place.

Rewards Calculators By Loyalty Program

American Express Membership Rewards

Chase Ultimate Rewards Points Calculators

Capital One Miles Calculators

Citi ThankYou Rewards Points Calculators

American Airlines AAdvantage Miles Calculators

Delta Air Lines SkyMiles Calculators

Southwest Rapid Rewards Points Calculators

United Airlines MileagePlus Miles Calculators

Hilton Honors Points Calculators

Marriott Bonvoy Points Calculators

World of Hyatt Points Calculators