Air France-KLM Flying Blue Miles Calculators

- Flying Blue Credit Card Miles Calculators

- Flying Blue Miles Value Calculators

- Flying Blue Miles Transfer Calculators

- Flying Blue Buy Miles Calculators

Quick Overview

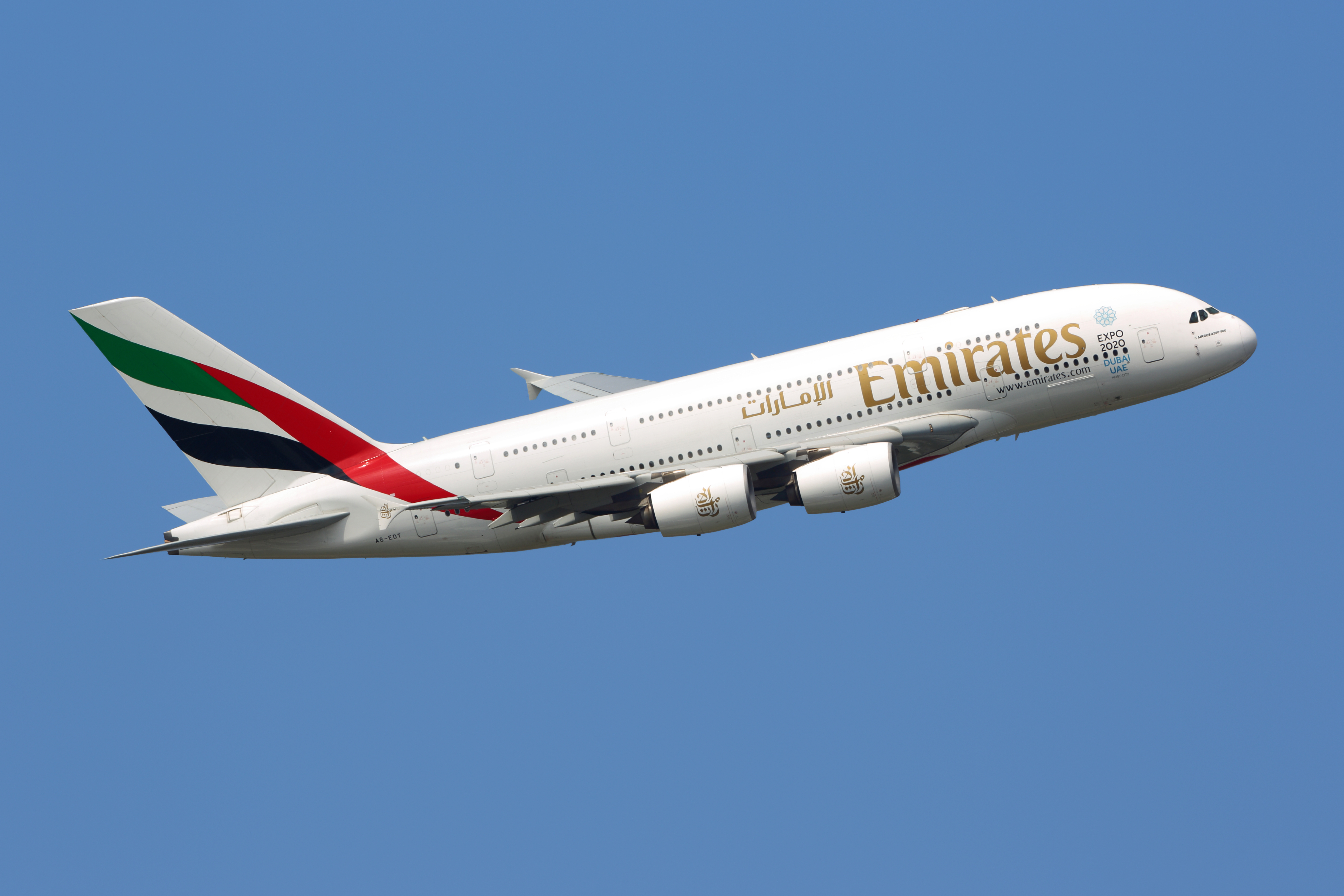

- Flying Blue miles are the rewards currency of Air France and KLM, both SkyTeam alliance members.

- You can earn Flying Blue miles by flying with Air France, KLM, their airline partners, booking hotels, renting cars, using credit cards, and shopping with Flying Blue partners.

- Flying Blue miles can be redeemed for award flights on Air France, KLM, SkyTeam airlines, and other partners, as well as for upgrades, baggage, and lounge access.

- Best value for Flying Blue miles comes from redeeming for award flights, while other redemptions may typically lower value.

- Flying Blue is partnered with all major U.S. credit card rewards programs—American Express, Chase, Citi, Capital One, and Bilt—offering top options for earning miles through bonuses and everyday spending.

Flying Blue Credit Card Miles Calculators

Flying Blue offers only one co-branded credit card in the U.S. for earning Air France-KLM miles on everyday purchases. While this card is a good option for Air France-KLM loyalists, you will typically find better value using one of the 30+ partner credit cards available through Flying Blue’s transfer partners.

Use our Flying Blue miles calculator to calculate total miles and card value for Flying Blue credit cards based on your spend and card benefits, minus any fees. Results can be compared alongside other credit cards featured on the site.

Use our Rewards Calculator Tool to find out which credit cards will earn you the most Flying Blue miles and best value. Input your monthly spend, adjust point values, assign values to card benefits, and much more!

Flying Blue Miles Value Calculators

Flying Blue miles can be redeemed for award flights, seat upgrade, baggage, lounge access, hotels, merchandise and more. Your Flying Blue miles will have the best value when redeemed for award flights.

Use our Flying Blue miles value calculator to determine the average dollar cost of Flying Blue miles based on redemption.

Flying Blue Miles Transfer Calculators

Flying Blue is a direct transfer partner of all major U.S. credit card rewards programs. This gives you over 15 programs you can use to earn miles which includes over 30 credit cards you can use to earn additional miles via intro bonuses and everyday spending.

Learn more about Flying Blue transfer partners and use our conversion calculators to convert rewards earned with partners into Flying Blue miles.

- Calculator: Flying Blue Transfer Partners

- Calculator: Which Credit Card Points Transfer To Flying Blue?

Program specific Flying Blue miles transfer calculators:

- Calculator: AMEX Membership Rewards Points To Flying Blue Miles

- Calculator: Capital One Miles To Flying Blue Miles

- Calculator: Chase Ultimate Rewards Points To Flying Blue Miles

- Calculator: Citi ThankYou Rewards Points To Flying Blue Miles

Flying Blue Buy Miles Calculators

Flying Blue miles can be purchased from the buy Flying Blue miles portal to easily top off your account. This can be a solid route to take if you're a few miles short of a redemption or if you can redeem them for higher value than what you paid for them.

Get the details on buying Flying Blue miles and use our Buy Flying Blue miles calculator to see how much Flying Blue miles will cost you at the base rate.