Qantas Points Calculators

Quick Overview

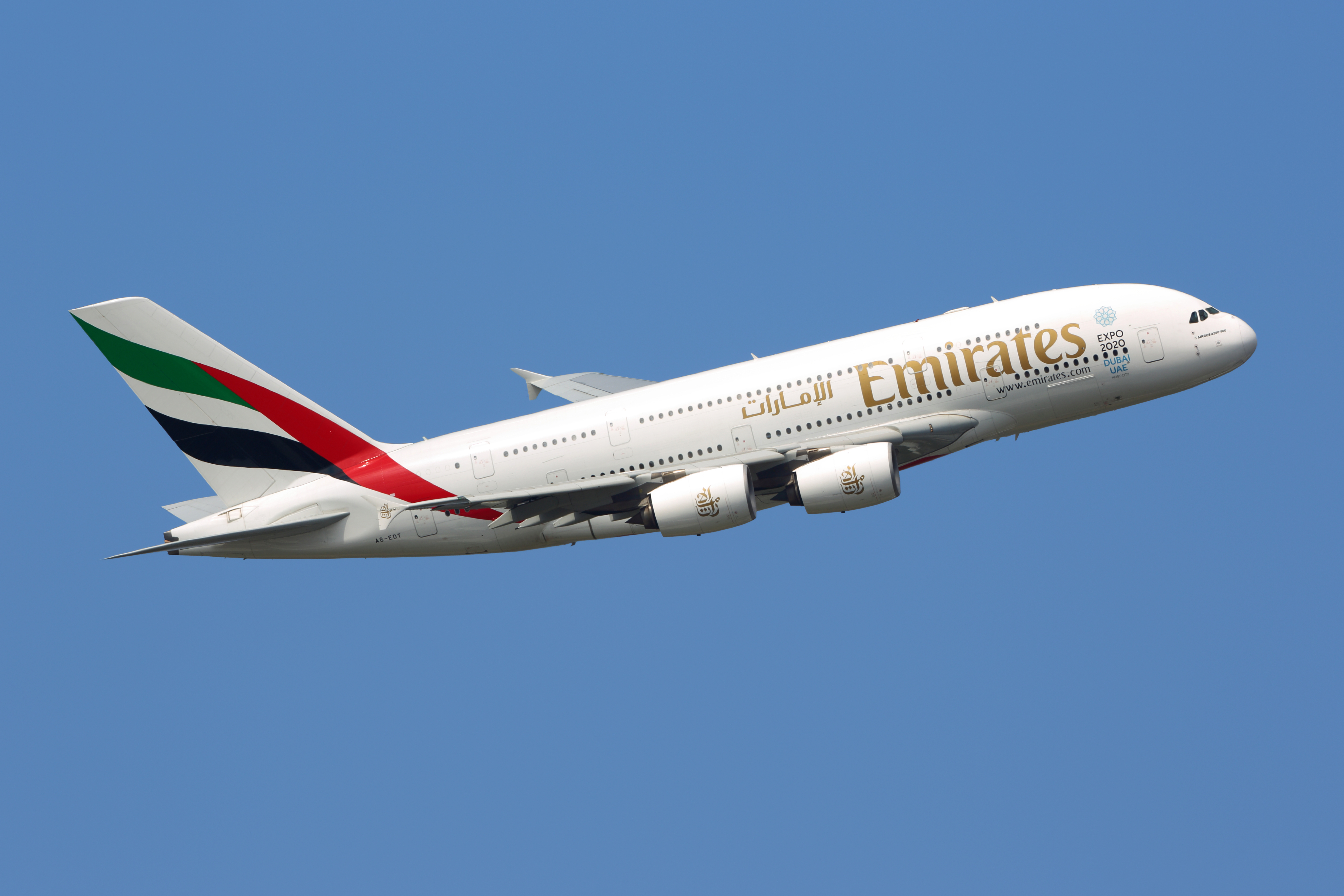

- Qantas Frequent Flyer points are the rewards currency of Qantas, a member of the oneworld Alliance.

- Earn Qantas points by flying Qantas, oneworld Alliance partners, and global airline partners, as well as through hotel bookings, car rentals, credit card spending, and retail partners.

- Maximize Qantas points value by redeeming them for award flights with Qantas and partner airlines. Points can also be used for seat upgrades, hotels, car rentals, and more.

- Qantas is a major transfer partner of American Express, Citi, and Capital One, making it easy to earn hundreds of thousands of points through credit card intro bonuses and everyday spending in the U.S.

Qantas Credit Card Points Calculators

Qantas does not offer any co-branded credit cards in the United States, but they are a direct transfer partner of several major credit card rewards programs and hotel loyalty programs. This makes it fairly easy to earn lots of Qantas points via intro bonuses and everyday credit card spend.

Use our Rewards Calculator Tool to find out which credit cards will earn you the most Qantas points and best value. Input your monthly spend, adjust point values, assign values to card benefits, and much more!

Qantas Transfer Partner Calculators

Qantas points can be earned transferring rewards from AMEX, Capital One, Citi and a few select other programs directly into your Qantas Frequent Flyer account.

Use our Qantas Transfer Partner Calculators to determine how many Qantas points you'll earn when transferring points from partners or spending on partner credit cards.

- Qantas Transfer Partners: Transferring Rewards To Qantas

- Calculator: Which Credit Card Points Transfer To Qantas?

Program specific Qantas transfer calculators:

Earn points paying rent with no transaction fee using the Bilt Mastercard®.

Redeem points towards future rent payments or transfer them to airline and hotel loyalty programs.

Earn status with Bilt Rewards and get treated like a VIP in your neighborhood with bonus points and access to exclusive benefits at local restaurants, fitness studios, and more.

Learn more