AMEX Membership Rewards Points Value Calculator

Quick Overview

- Flexible Redemption Options: AMEX points can be redeemed for travel, gift cards, statement credits, or transferred to airline and hotel partners.

- Maximize Value with Airline Transfers: Transferring points to airline partners offers the highest value, often up to 2 cents per point.

- Strong Hotel Transfer Value: Transfers to hotel partners can provide excellent value, frequently exceeding 1 cent per point, especially during peak travel periods or at luxury properties.

- Base Redemption Value: AMEX points have a base value of 1 cent per point when used for flights through American Express Travel®—the minimum value you should accept.

- Lower Value for Other Redemptions: Most other redemptions, including non-flight travel options, typically yield less than 1 cent per point.

Use our AMEX points value calculator to convert AMEX points to dollars when redeemed for travel, gift cards, statement credits, and more.

AMEX points value

Membership Rewards points offer an easy range of 0.5 cents to 1 cent in value per point meaning that you can redeem 10,000 points for a value of $50 to $100 with no effort. Higher redemption values will either require a certain combination of Membership Rewards credit cards or research on which transfer partners will give you the best bang for your point.

Here's our breakdown of AMEX points value based on redemption:

| Redemption option | AMEX points value (in cents) |

|---|---|

| Point transfers to airline partners | 1.2 - 2 |

| Point transfers to hotel partners | 0.4 - 1 |

| Booking flights through American Express Travel | 1 - 2 |

| Booking Fine Hotels & Resorts | 1 |

| Booking other travel through American Express Travel | 0.7 |

| Paying with points at checkout | 0.7 |

| Using points for card charges (statement credit) | 0.6 |

| Redeeming points for gift cards | 0.5 - 1 |

Point transfers to airline partners

Transferring Membership Rewards points to airline partners will give your points a value of about 1.2 to 2 cents per point depending on the airline and how they are redeemed. You'll get the highest value when aiming for premium, First, and Business class cabins after transferring your points.

Here's a few of the best options when it comes to transferring Membership Rewards points to airline partners:

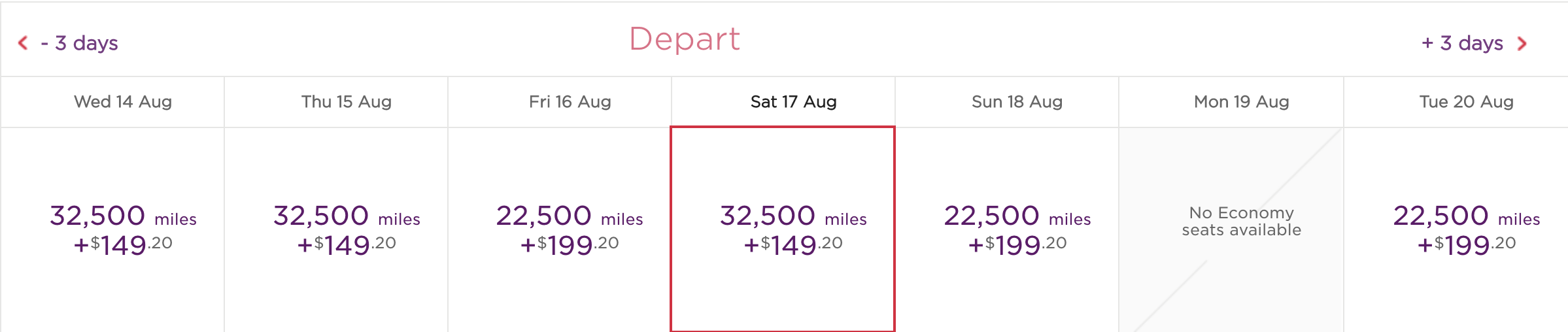

- Delta Airlines: Delta offers great promotion sales from time to time that can net you some fantastic value when redeeming SkyMiles. They also have great deals on short-haul, one-way flights throughout the United States.

- Virgin Atlantic: Virgin offers great award redemption flying from U.S. West Coast to Asia and from U.S. East Coast to Europe. You can also use them to book Delta One flights at a cheaper cost than using Delta's own SkyMiles.

- British Airways: British Airways' award chart is based on distance which makes Avios fantastic for short-haul trips. This especially holds true for booking short-haul trips with American Airlines and Alaska Airlines using Avios such as a flight between the West Coast and Hawaii for example.

- Singapore Airlines: While there are many sweet spots with Singapore Airlines, they are most known for their premium in-air First Class Suites which (if you can find award space) will offer exceptional value.

- Air France-KLM: The Flying Blue program provides great value when flying between the U.S. and European destinations. They also have monthly promos to select cities that can net you some serious value.

Point transfers to hotel partners

When transferring Membership Rewards Points to American Express hotel partners, you can expect an average value of around 0.4 to 1 cent per point. While this is significantly lower than the value airline partners offer on average, it is possible to get higher value when booking high-end resorts or hotels in popular destinations (e.g. Maldives, Bora Bora, islands, beaches, etc).

Here are few of the best hotel transfer partners for Membership Rewards:

- Marriott Bonvoy: There are many sweet spots in the Marriott Bonvoy program. This will typically be Marriott's lower end hotels (e.g. Category 1-2) and Marriott's high-end hotels (Category 7-8) which can offer anywhere between 1 and 2 cents per point.

- Choice Privileges: Choice Points provide a solid value when booking stays in expensive cities, particularly European cities such as London in which you can easily squeeze 1 cent or more out of your points. Choice is also great for when you're visiting cities that are "off the beaten path" as there are many instances of cities in which Choice is the only option with no other major brand anywhere in the vicinity.

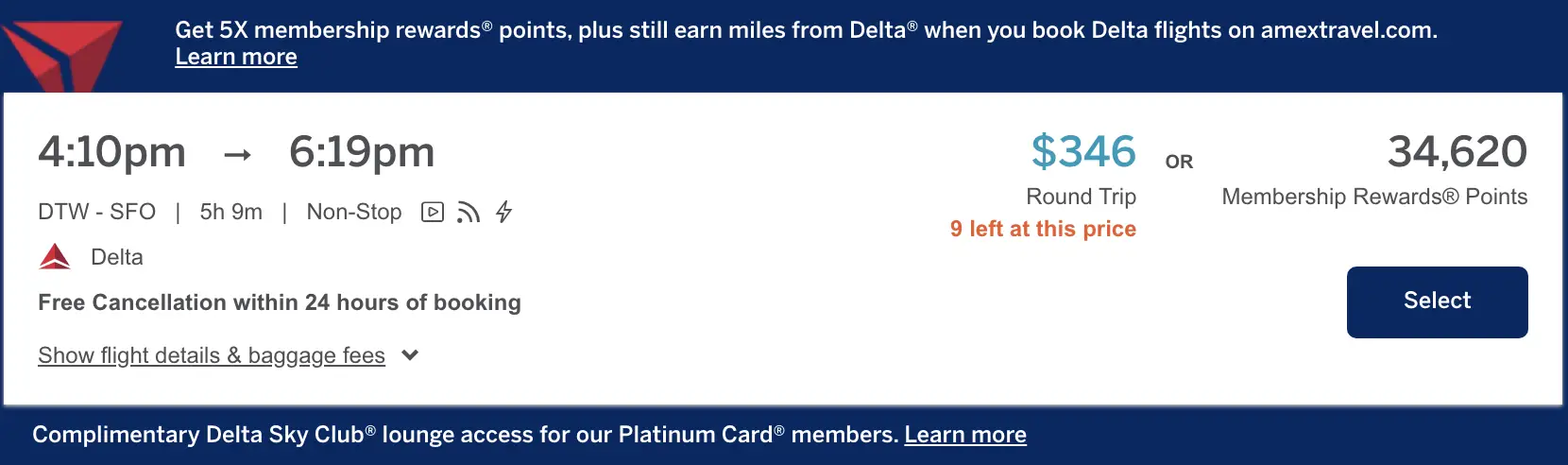

Booking flights through AMEX Travel

When you redeem your Membership Rewards Points for airfare through the American Express Travel, they will have a value of 1 cent each. This means a $300 flight would cost you 30,000 Membership Rewards Points to cover it.

The exception to this is by using The Business Platinum Card® from American Express which offers a 35% rebate. This rebate gives you 35% of your points back (about a month later) on bookings through American Express Travel which bumps up the value of your points to 1.54 cents each.

If you've built up a lot of points and you want an easy way to redeem them for fantastic value, grabbing up the Business Platinum is a route to take.

Booking hotels through AMEX Travel

You can use Membership Rewards Points to book hotel stays through the American Express Travel Portal. You'll get 1 cent per point booking Fine Hotels & Resorts and 0.7 cents per point for all other redemptions.

- Fine Hotels & Resorts: If you have a personal or business version of the Platinum Card, you'll be able to book stays through Fine Hotels & Resorts. Room upgrades, daily breakfast for two people, guaranteed 4pm late check-out, noon check-in, complimentary Wi-Fi, and a unique property amenity, such as a spa or food & beverage credit comes with Fine Hotels & Resorts reservations.

- The Hotel Collection: The Hotel Collection is available to personal and business cardholders of Platinum and Gold cards. You'll receive a $100 hotel credit to spend on qualifying dining, spa, and resort activities and can also receive a room upgrade at check-in if available for The Hotel Collection reservations.

Upgrade with points

Membership Rewards Points can be used to place an offer towards a seat upgrade with more than 20 airlines.

After you've purchased your ticket with a participating airline, you can jump to the American Express Travel Site to enter your reservation details. If the itinerary is eligible for an upgrade, you can then use points to make an offer.

You will find out where or not the offer has been granted usually within 5 days of the flight.

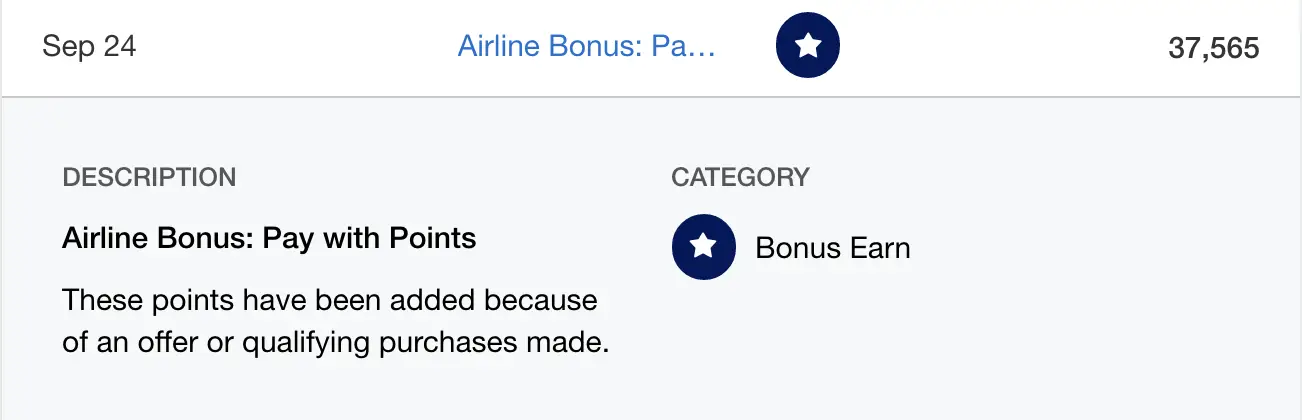

Pay with Points

The Pay With Points program allows you to redeem your points at checkout with top retailers. This will give you 0.7 cents in value per point with the majority of the listed partners.

While not the best use of points, it's nice to have an option that can help the cost off your bill at checkout. The option to pay with Points will typically appear if you have a Membership Rewards credit card attached to your account.

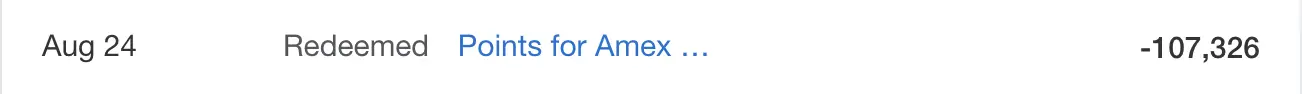

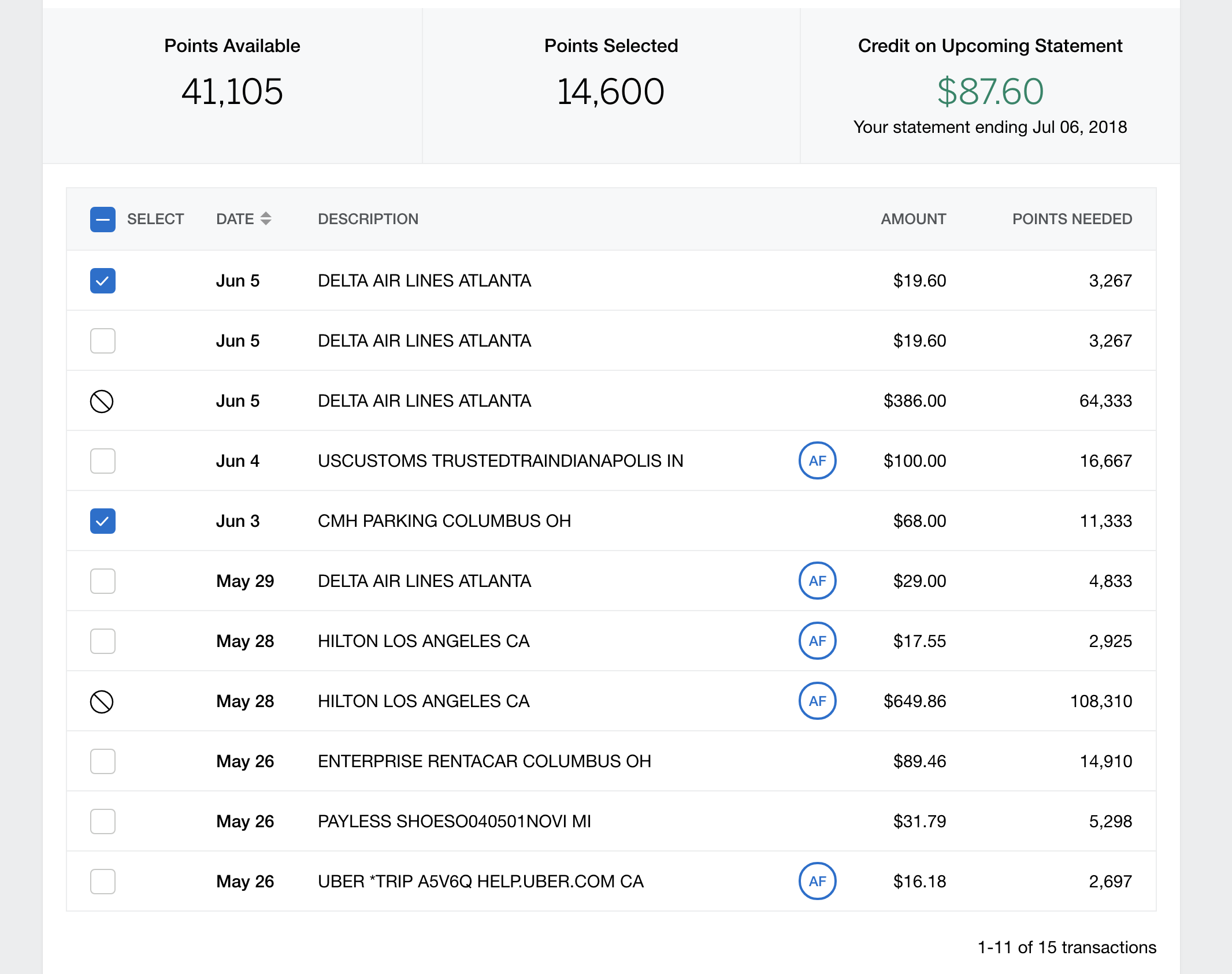

Card charges and statement credits

Membership Rewards Points can be redeemed towards card charges for a value of 0.6 cents per point. You can use your points to cover card charges made to any of your Membership Rewards credit cards regardless of how the points were obtained.

When redeeming your Membership Rewards Points, AMEX allows you to pick which charges you want to cover using your points. If you do not have enough points to cover the charge, it will not allow you to use partial points to cover it.

Very rarely, AMEX will offer promotions in which you can redeem points for 1 cent each for statement credits. I've only seen this a handful of times, so don't count on it too much.

Gift cards

Membership Rewards Points can be redeemed for over 90 different gift cards consisting of restaurants, retail stores, entertainment and more. The value you get out of redeeming your points for gift cards will range between 0.5 cents and 1 cent in value.

Shop with points

You can use Membership Rewards Points to shop the Membership Rewards store. It features a range of departments such as technology, home & office, sports & games, and more.

It also has brand name products from top companies such as Apple, Sony, and Google. Redeeming your AMEX points through the shopping portal will give them a value of 0.5 cents each which is one of the lowest redemption values for Membership Rewards Points.

Unless you find a deal within the Membership Rewards store, you would be better off using your card to make the purchase and then using points to cover the card charges.

AMEX points to dollars calculator

Use our AMEX Points Value Calculator to estimate the dollar value of your points based on different redemptions. Find out how much your AMEX points are worth on average.

Calculator: How Much Are Your AMEX Membership Rewards Points Worth?

| Redemption | Average Dollar Value |

|---|---|

| Transferring points to airline partners | $0 to $0 |

| Transferring points to hotel partners | $0 to $0 |

| AMEX Travel airfare via Business Platinum Card's 35% rebate | $0 |

| All other AMEX Travel airfare bookings | $0 |

| AMEX Travel hotels through Fine Hotels & Resorts | $0 |

| All other AMEX Travel hotel bookings | $0 |

| Pay with Points at checkout | $0 |

| Card charges & statement credits | $0 |

| Gift cards | $0 - $0 |

| Shopping portal | $0 |

AMEX points average value

The table below lists the value of Membership Rewards points for several denominations when valued at their simplest value of 1 cent per point. Do note, that transferring points to airline partners can easily offer more than 1 cent in value since airline miles are generally worth more than 1 cent each.

| AMEX Points | Cash Value |

|---|---|

| 1 Point | $0.01 |

| 1,000 Points | $10 |

| 5,000 Points | $50 |

| 10,000 Points | $100 |

| 15,000 Points | $150 |

| 20,000 Points | $200 |

| 25,000 Points | $250 |

| 40,000 Points | $400 |

| 50,000 Points | $500 |

| 60,000 Points | $600 |

| 70,000 Points | $700 |

| 80,000 Points | $800 |

| 90,000 Points | $900 |

| 100,000 Points | $1,000 |

| 150,000 Points | $1,500 |

| 300,000 Points | $3,000 |

| 500,000 Points | $5,000 |

| 1,000,000 Points | $10,000 |

AMEX redemption value calculator

Use the AMEX Redemption value calculator to determine if a redemption is worth it based on the cost in cash and the cost in AMEX Membership Rewards points. Try to aim for redemptions that give you 1 cent or more per point.

How does AMEX points value compare?

Here's how the value of AMEX points compare against rewards earned with other leading travel programs:

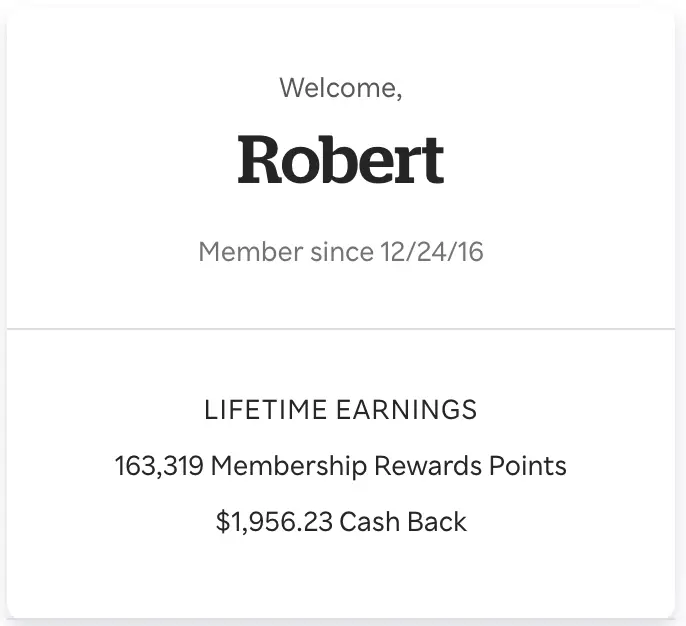

How to earn Membership Rewards points

Membership Rewards points are primarily earned spending across Membership Rewards credit cards. You can also earn points shopping at thousands of retailers online with Rakuten Rewards.

Membership Rewards credit cards

Membership Rewards points are primarily earned spending across Membership Rewards credit cards. Every $1 spent across these cards will earn at least 1 point along with any bonus points the card may offer spending in select categories.

Here are the credit cards you can use to earn Membership Rewards points:

- Earn 5X points on flights booked directly with airlines or with American Express Travel® (up to $500,000, then 1X)

- Earn 5X points on prepaid hotels booked through American Express Travel®

- Earn 1X points on all other eligible purchases

- Global Airport Lounge Access including Centurion Lounges, Delta Sky Club Lounges (when flying Delta), Airspace Lounges, Escape Lounges, and Priority Pass Lounges

- Over $1,400 in annual credits which includes airline incidentals, Uber Cash, digital entertainment, Fine Hotels + Resorts and The Hotel Collection, and more

- Enjoy complimentary Marriott Bonvoy Gold Elite status and Hilton Honors Gold status (enrollment required)

- Terms Apply

- $695 annual fee (See Rates and Fees)

- Card Value & AMEX Platinum Points Calculator

- Earn 4X points at restaurants worldwide, on up to $50,000 in purchases per calendar year (then 1X)

- Earn 4X points at U.S. supermarkets, on up to $25,000 in purchases per calendar year (then 1X)

- Earn 3X points on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X points on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X points on all other purchases

- Receive up to $400+ in annual credits each year

- Terms Apply

- $325 annual fee (See Rates and Fees)

- Card Value & AMEX Gold Points Calculator

- Earn 5X points on flights and prepaid hotels on amextravel.com

- Earn 1.5X points (that’s an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more, on up to $2 million per Card Account per calendar year. Purchases eligible for multiple additional point bonuses will only receive the highest eligible bonus

- Earn 1X points on all other eligible purchases

- Global Airport Lounge Access including Centurion Lounges, Delta Sky Club Lounges (when flying Delta), Airspace Lounges, Escape Lounges, and Priority Pass Lounges. Access is limited to eligible Card Members.

- Over $1,400 in annual credits which includes Dell, Adobe, Indeed, CLEAR, and more

- NEW! Make the Business Platinum Card® work even harder for you. Hilton For Business members get up to $200 back per calendar year when you make an eligible purchase at Hilton properties across the globe. Benefit enrollment required.

- Get 35% points back when you redeem points for all or part of an eligible flight booked with AMEX Travel

- Enroll in complimentary Marriott Bonvoy Gold Elite status and Hilton Honors Gold status

- Terms Apply

- $695 annual fee (See Rates and Fees)

- Card Value & Business Platinum Points Calculator

- Earn 4X points on the 2 select categories where your business spent the most each billing cycle, on up to $150,000 per year (then 1X)

- Earn 3X points on flights and prepaid hotels booked on AmexTravel.com

- Earn 1X points on all other purchases

- Terms Apply

- $375 annual fee (See Rates and Fees)

- Card Value & Rewards Calculator

- Earn 2X points on the first $50,000 in purchases per year, then 1 point per dollar thereafter

- Terms Apply

- $0 annual fee (See Rates and Fees)

- Card Value & Rewards Calculator

Rakuten Rewards

Rakuten Rewards is an online cash back shopping rewards website that pays you to shop online. It hosts thousands of affiliate links and when you make a purchases through those links, you'll receive a small percentage of the money Rakuten earns off of that affiliate purchase.

Rakuten is partnered with American Express which allows you to earn Membership Rewards points instead of cash back if you have at least one Membership Rewards point-earning credit card. Membership Rewards points earned with Rakuten is at a 1%:1X rate meaning that if Rakuten is offering 10% cash back with a retailer, that would be equal to a whopping 10X Membership Rewards points per $1 spent.

And not only will you earn bonus points through Rakuten, you will also still earn the rewards from the credit card you use to pay for your purchases AND any rewards from the retailer if they offer them and you're signed into your rewards account.

If you shop online and you have at least one Membership Rewards credit card, I highly suggesting sign up up for Rakuten and using the site whenever you can when shopping online as there are really no drawbacks. There's no fee to use Rakuten so it's really just free money from doing what you would normally do... shop online!

Sign up for Rakuten Rewards today and earn bonus cash back or Membership Rewards points the first time you use the site.

Rakuten Rewards: Sign up for free

We've run the calculations and checked them twice — here are the credit cards that consistently provide outstanding value to our users:

- Best flexible travel card: Capital One Venture Rewards Credit Card

- Best for high cash back: Blue Cash Preferred® Card from American Express

- Best for foodies: American Express® Gold Card

- Best for business travel rewards: Ink Business Preferred® Credit Card

- Best for heavy business spenders: Capital One Spark Cash Plus

AMEX Membership Rewards Points Calculators & Guides

-

Calculator: AMEX Points To Miles & Hotels

View the list of AMEX transfer partners and calculate the transfer of AMEX points to airline and hotel rewards programs. -

AMEX Membership Rewards Points Value Calculator

Get the details on what you can redeem AMEX points for and find out which redemptions will give you the most value. -

Calculator: AMEX Points to Amazon Cash Value

Get the details on redeeming Membership Rewards points at checkout on Amazon.com and calculate the average value. -

Calculator: Rakuten Cash Back vs AMEX Membership Rewards

Have a Membership Rewards credit card? Earn bonus AMEX points shopping online with thousands of retailers using Raktuten Rewards. -

Calculator: The Platinum Card® from American Express

View the card benefits and calculate total AMEX Platinum points and card value based on your spend. -

Calculator: American Express® Gold Card

View the card benefits and calculate total AMEX Gold points and card value based on your spend. -

Calculator: American Express® Green Card

View the card benefits and calculate total AMEX Green points and card value based on your spend. -

Calculator: The Business Platinum Card® from American Express

View the card benefits and calculate total Business Platinum points and card value based on your spend. -

Calculator: American Express® Business Gold Card

View the card benefits and calculate total Business Gold points and card value based on your spend. -

Calculator: Business Green Rewards Card from American Express

View the card benefits and calculate total Business Green points and card value based on your spend. -

Calculator: The Blue Business® Plus Credit Card from American Express

View the card benefits and calculate total Blue Business Plus points and card value based on your spend.