Calculator: What's The Value of Walmart Rewards Points?

Quick Overview

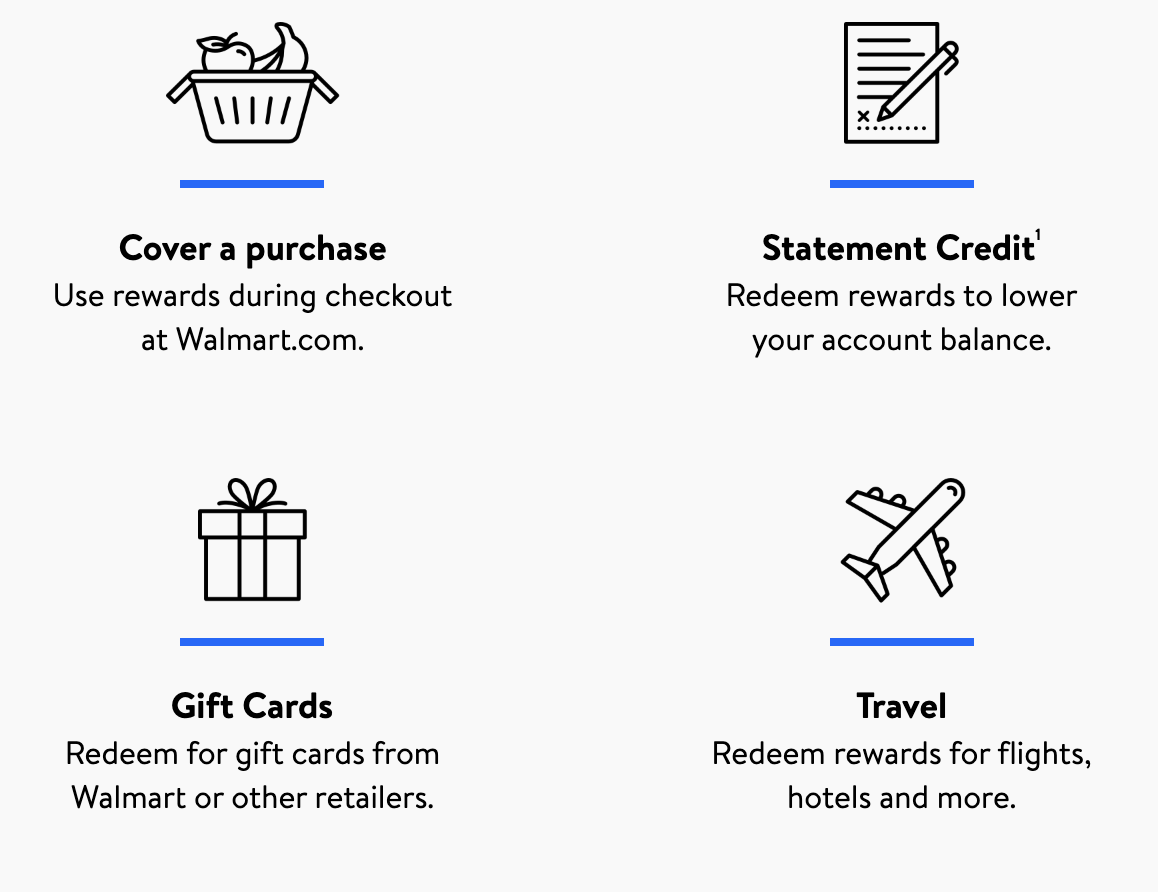

- Flexible Redemption Options: Use Walmart Rewards points for cash, statement credits, gift cards, travel, or to offset card purchases.

- Point Value: 100 Walmart Rewards points equals $1 in cash value, giving points a straightforward value of 1 cent each.

Use our Walmart Rewards Points Calculator to convert Walmart Rewards points to dollars when redeemed for cash back, travel, and more.

Walmart Rewards points value

Walmart Rewards points are worth 1 cent each meaning that every 100 points you earn is equal to $1 in value with Walmart.

Here's our valuations for Walmart Rewards points:

| Redemption options | Redemption point value (in cents) |

|---|---|

| All redemptions | 1 |

Redeeming points for cash

Walmart Rewards points can be redeemed for cash at a value of 100 points for $1. When redeeming rewards for cash you can choose to receive a check or you can apply your rewards as a statement credit to your card.

Using points at checkout online

Walmart Rewards points can be redeemed at checkout when shopping at walmart.com. During checkout, you will be asked to specify how much cash back you want to apply towards your purchase.

Those points will then be deducted from your balance and applied to your account in the form of a credit 2-3 business days later.

Redeeming points for previous purchases

Walmart Rewards Points earned with the Capital One® Walmart Rewards® Mastercard® and Capital One Walmart Rewards Credit Card can be applied to purchases you've already made with Walmart. You can do this through the Capital One App or through walmart.capitalone.com.

The redemption must be made within 90 days of the purchase posting to your account and will post to your account as a credit within 2-3 business days. Redemptions for a portion of a purchase amount (partial redemptions) are also available using this method.

Redeem for gift cards

Walmart Rewards points can be redeemed for gift cards. This includes gift cards for Walmart or for other popular retailers.

Use points for travel

Those who have the Capital One Walmart Rewards Mastercard will also be able to redeem their rewards for travel which includes flights, car rentals, and hotels.

Travel redemptions are at a 1:1 ratio meaning 1 point equals 1 cent towards travel. Those with the Capital One Walmart Rewards Credit Card (Store Card) will not be able to redeem their rewards for travel.

Walmart points to dollars calculator

Use our Walmart Rewards Points Calculator to determine the dollar value of Walmart Rewards points when redeemed at Walmart for purchases, gift cards, and more. This will give you an idea of how much your points are worth.

Calculator: How much are your Walmart Rewards points worth?

| Walmart Rewards points value: | $0 |

|---|

We've run the calculations and checked them twice — here are the credit cards that consistently provide outstanding value to our users:

- Best flexible travel card: Capital One Venture Rewards Credit Card

- Best for high cash back: Blue Cash Preferred® Card from American Express

- Best for foodies: American Express® Gold Card

- Best for business travel rewards: Ink Business Preferred® Credit Card

- Best for heavy business spenders: Capital One Spark Cash Plus

Walmart Points Calculators & Guides

-

Calculator: What's The Value of Walmart Rewards Points?

Find out how much Walmart Rewards points are worth when redeemed in-store and online with Walmart and calculate the dollar value. -

How To Earn Bonus Cash Back Using Online Shopping Portal

Get the scoop on how to use shopping portals to double and triple-dip on rewards... for free!