Calculator: Rakuten Cash Back vs AMEX Membership Rewards

Quick Overview

- Shop and Earn Rewards: Rakuten is an online cash-back portal with thousands of affiliate retailers, sharing a portion of its earnings with you as cash back when you shop through its links.

- Membership Rewards Option: Through a partnership with American Express, Rakuten lets you earn Membership Rewards points instead of cash back, at a rate of 1% cash back = 1X points.

- Eligibility Requirement: To earn Membership Rewards points via Rakuten, you must have an eligible AMEX Membership Rewards credit card.

- Stack Rewards for Maximum Value: Points earned through Rakuten are in addition to rewards from your AMEX credit card and retailer loyalty programs, letting you triple-dip on rewards.

- Free Signup Bonus: Rakuten is free to join, with a signup bonus of $30 or more on your first purchase through the portal.

Read on to learn more about the Rakuten AMEX partnership and how you can maximize your Membership Rewards points using the Rakuten Rewards portal.

How does Rakuten work?

Rakuten is a free online cash-back portal with thousands of affiliate retailers. When you make a purchase through Rakuten's links, the platform earns a commission and shares a portion of it with you.

How Rakuten Works:

- Start Shopping: Begin your shopping session at rakuten.com.

- Choose a Retailer: Find your preferred store and click "Shop Now" to be redirected to the retailer’s website.

- Shop Normally: Complete your purchase as usual, and log into the retailer's loyalty account if applicable.

- Purchase Tracked: After your purchase, Rakuten is notified of the transaction.

- Earn Rewards: Rakuten pays you a percentage (or sometimes all) of the commission earned from the affiliate sale.

The AMEX Advantage with Rakuten

What sets Rakuten apart from other cash-back portals is its partnership with American Express. If you hold a Membership Rewards credit card, you can choose to earn Membership Rewards points instead of cash back at a rate of 1% cash back = 1X points.

This lets you easily rack up tens of thousands of extra points by shopping online—with zero downside.

Maximize Your Rewards

Rakuten Rewards enables double and triple-dipping for exceptional value:

- Earn Membership Rewards points through Rakuten.

- Earn points from the credit card you use to pay.

- Earn rewards from the retailer’s loyalty program, if applicable.

For example, booking travel with Avis as an Avis Preferred member through Rakuten Rewards earns:

- Membership Rewards points via Rakuten.

- Points from the credit card you use to pay for your purchase

- Avis Preferred points as an Avis Preferred member.

By comparison, booking directly with Avis would only earn credit card points and Avis Preferred points. Using Rakuten takes no extra effort, costs nothing, and ensures you don’t leave free rewards or points on the table.

How many Membership Rewards points can you earn with Rakuten Rewards?

When surfing the Rakuten Rewards website, you'll see thousands of retailers along with the current cash back offers.

The most important thing to note is that Rakuten does not change the lingo on their website to reflect that you've switched your account to Membership Rewards Points. After switching, Rakuten will occasionally remind you that you're earning points, but the offers throughout the site will always reflect cash back.

The cash back to Membership Rewards point ratio is 1% to 1 point. So if a retailer is offering 10% cash back (which they do quite often) this would be equal to earn 10 Membership Rewards points per $1 spent.

For example, look at this previous deal for Saks Fifth Avenue:

If you were to spend $500 with Saks Fifth during this promo, you would earn a whopping 5,000 Membership Rewards points. At our valuations, this is equal to anywhere from $50 to $100 in value which is insane.

On top of that, you would also earn rewards with the credit card you use to pay for your purchase and rewards with Saks Fifth if you were signed into your Saks Fifth account.

Learn More: AMEX Points Value Calculator

Do you have to use a Membership Rewards credit card?

Rakuten and AMEX does not require you to use a Membership Rewards credit card in order for you to earn Membership Rewards Points through your Rakuten account. This means you can use whatever rewards credit card you want, meaning that you to earn points across multiple rewards programs.

For example, let's say IHG is offering 3% cash back on purchases through Rakuten and you wanted to use a credit card that earns a high return on travel such as the Citi Strata Premier Card. If you were to book through Rakuten and complete your stay through IHG, you would earn:

- 3 ThankYou Rewards points per $1 spent with the Citi Strata Premier Card.

- 3 Membership Rewards Points per $1 spent through Rakuten.

- Up to 20 IHG Points per $1 spent based on your membership in the IHG One Rewards program.

That's a lot of valuable points which is why I heavily recommend booking travel using cash back portals regardless of whether you're earning cash back or points.

How do you get paid your Membership Rewards points?

Rakuten pays its members four times per year depending on when you earned your rewards. Generally, you'll earn 3 months worth of rewards and then get paid for those three months about a month-and-a-half later. This is different from most other portals which allows you to cash out your rewards as you earn them.

| Earning Period | Date Paid Out |

|---|---|

| January 1 - March 31 | May 15 |

| April 1 - June 30 | August 15 |

| July 1 - September 30 | November 15 |

| October 1 - December 31 | February 15 |

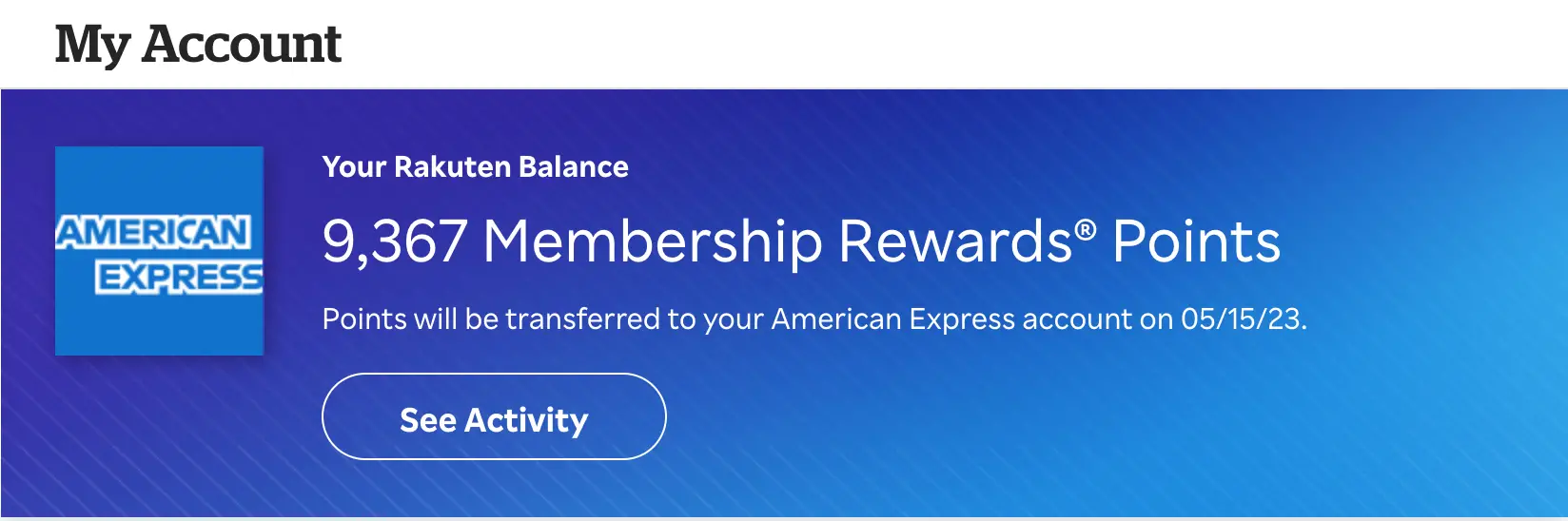

When your Membership Rewards Points are paid out to you, they will be deposited into your Membership Rewards account for you to use as normal. So if you use Rakuten for everything under the sun, you'll receive a large amount of Membership Rewards Points each quarter.

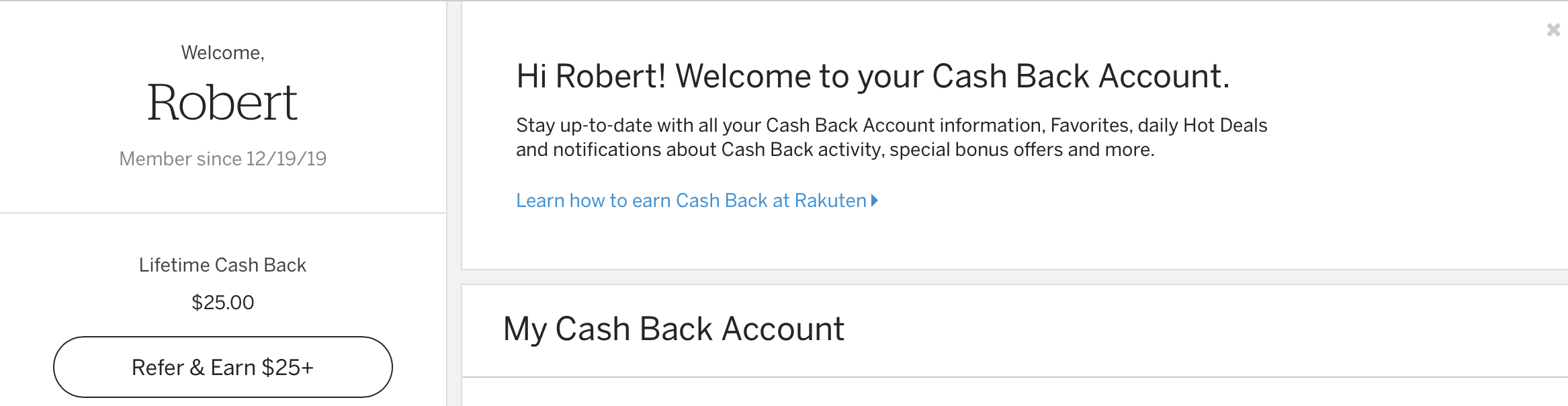

How to switch to your Rakuten account to Membership Rewards points

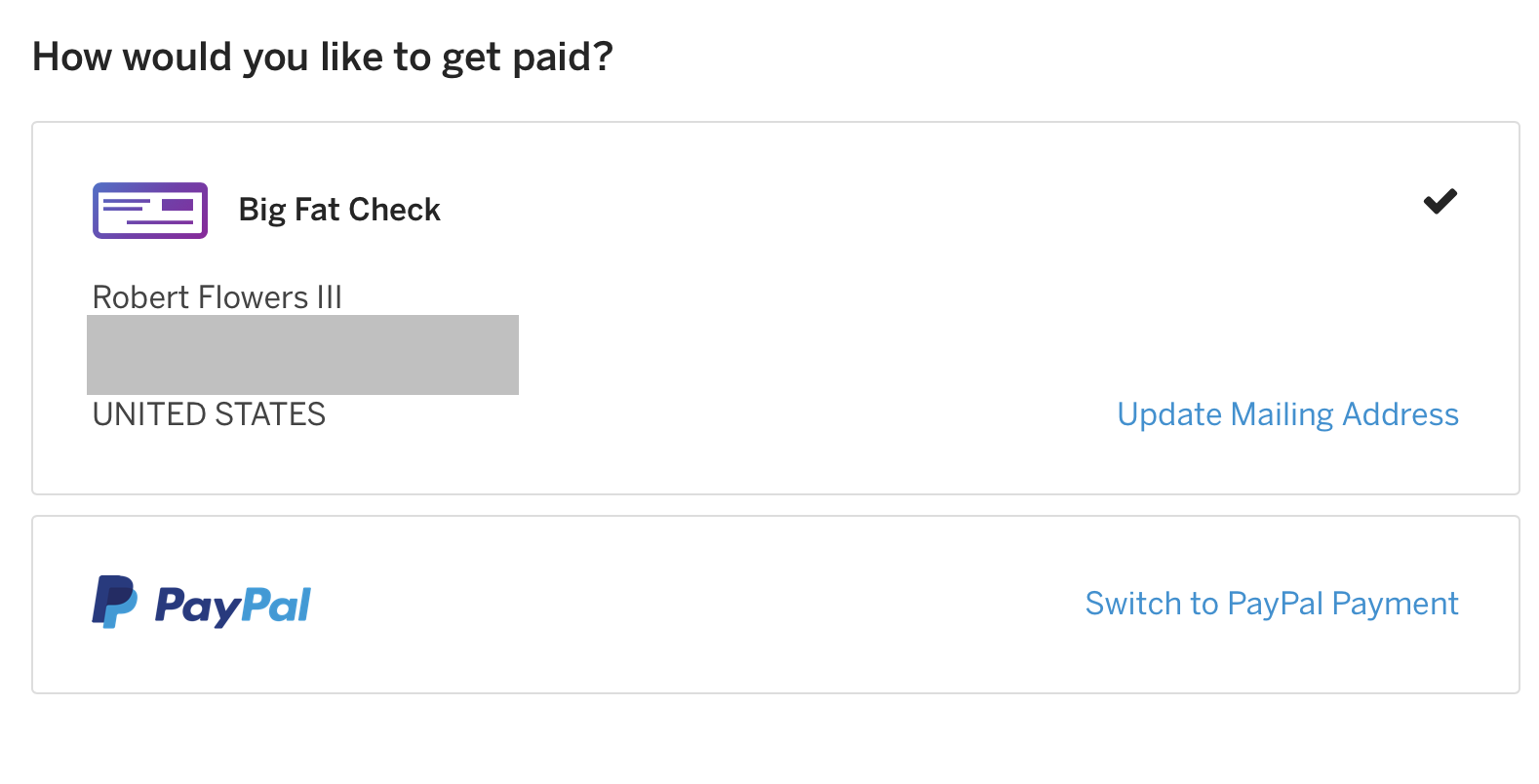

Once you sign up for a free Rakuten Rewards account, you'll be asked how you want to receive your rewards. You'll be given the options of Big Fat Check (paper check mailed to you), PayPal, or Membership Rewards Points.

If you already have a Rakuten Rewards account, you can switch to earning Membership Rewards points following these steps:

- Head to Rakuten.com.

- Click on your name in the upper right hand corner and go to Account Settings.

- Choose Switch to Membership Rewards Points as your method of payment.

- Rakuten will notify you that it will payout any cash back you've earned.

- You'll be asked to log into your American Express online account to verify if you're eligible.

- If eligible, Rakuten will email you a 6-digit code. Enter that code into the box asking for it.

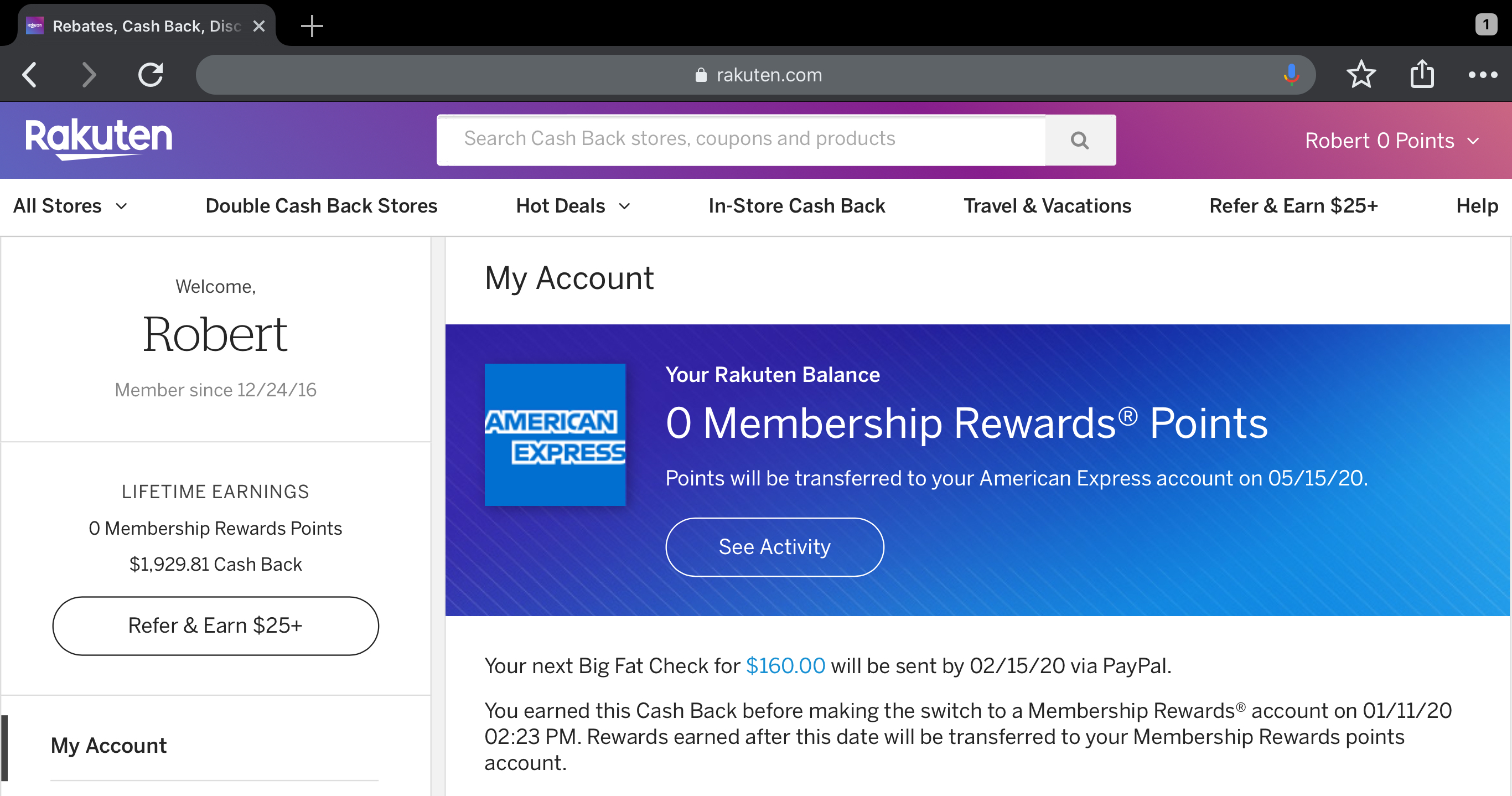

You can go to your My Account page to see any important notifications that you may have pertaining to the switch to Membership Rewards.

When looking under My Account, you'll now see Membership Rewards Points reflected under Lifetime Earnings along with any cash back you may have earned since you've had the account opened. It will also keep track of how many points you've earned during the pay schedule period and gives you the date in which those points will be transferred to your account.

As previously stated, any cash back you had will be paid out to you via either PayPal or Big Fat Check depending on how this was set up before you made the switch. This page will notify you of the date you'll receive that cash back. So if you have a preference, you'll want to select it before switching over to Membership Rewards Points.

Can you switch back to earning cash back?

If at anytime you decide you do not want to earn Membership Rewards, you can always switch back to Big Fat Check or PayPal as your payment method. This is done the same way by going to Account Settings and selecting a different method of payment. You'll be notified that you will not be able to switch back to Membership Rewards if you do so.

Any Membership Rewards Points you earned will be converted to cash back. So if you had 2,500 Membership Rewards Points in your balance, it will now say $25.

The Membership Rewards Points that were converted to cash back will not be paid out to you. You'll continue to earn cash back as you normally would with Rakuten. Just note that the ability to select Membership Rewards will be gone from your account:

If you ever wanted to earn Membership Rewards again, you would have to create a new Rakuten account. So be aware of that if you decide to switch back to earning cash back.

Rakuten AMEX Points Calculator

Use our Rakuten AMEX Points Calculator to estimate how many Membership Rewards points you'll earn on purchases through Rakuten Rewards.

| Airfare and point transfers to airline partners | - |

|---|---|

| Hotels and point transfers to hotel partners | - |

| Other forms of travel, gift cards, retail, and cash back / statement credits | - |

Rakuten cash back vs AMEX points

Which is better?

The short answer: If you're redeeming for travel, Membership Rewards points offer more value. Otherwise, stick with Rakuten Cash Back.

Airfare redemptions

If you plan on redeeming rewards for airfare, you will want to opt in to earn Membership Rewards points hands down. You can earn as much as a 100% return (or higher) with points over Rakuten cash back.

Rakuten Cash Back vs AMEX Points: Earning $100 in Rakuten cash back equals 10,000 Membership Rewards points, which can be worth $100 to $200+ when redeemed for airfare.

Membership Rewards Points are easily the better option.

Hotel redemptions

For hotels, it can lean either way. Some hotel redemptions, especially during peak travel seasons or at high-end resorts, will give Membership Rewards points significantly higher value.

Rakuten Cash Back vs AMEX Points: Earning $100 in Rakuten cash back equals 10,000 Membership Rewards points, worth $70 to $120+ when redeemed for hotel stays.

Winner depends on hotel types and if you travel during peak travel seasons.

Other redemptions

Other redemptions, such as gift cards, statement credits, online shopping, and non-airfare/non-hotel travel, are generally poor uses of Membership Rewards points, offering 1 cent or less in value.

Rakuten Cash Back vs AMEX Points: Earning $100 in Rakuten cash back equals 10,000 Membership Rewards points, worth $50 to $100 for gift cards, cash back, and non-airfare/hotel redemptions.

Earning Rakuten cash back is the clear winner.

Learn More: Membership Rewards Points Value

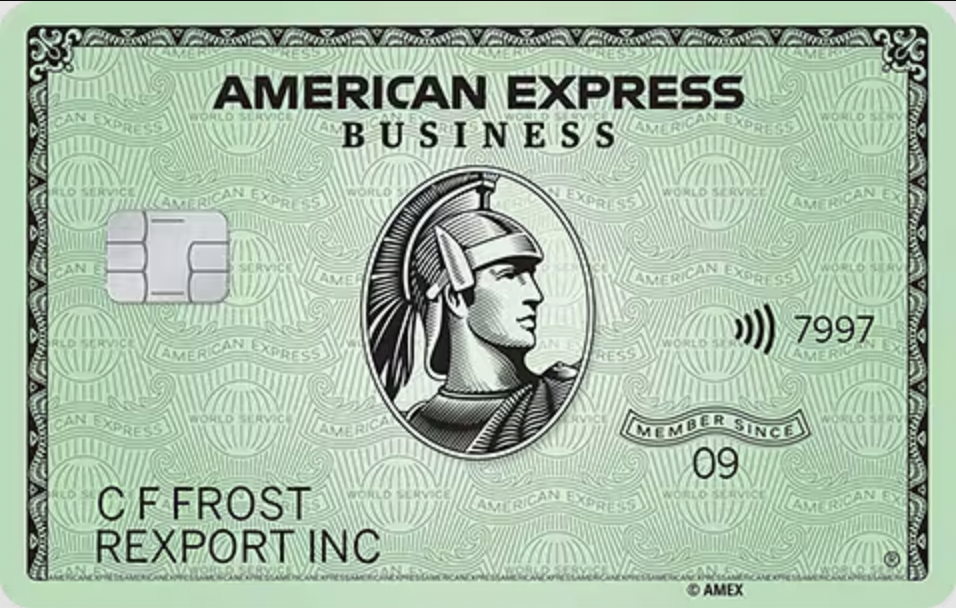

Credit cards that earn Membership Rewards points

If you're looking to earn Membership Rewards points using Rakuten Rewards, you'll need to have at least one eligible Membership Rewards credit card. Here are those cards:

- Earn 5X points on flights booked directly with airlines or with American Express Travel® (up to $500,000, then 1X)

- Earn 5X points on prepaid hotels booked through American Express Travel®

- Earn 1X points on all other eligible purchases

- Global Airport Lounge Access including Centurion Lounges, Delta Sky Club Lounges (when flying Delta), Airspace Lounges, Escape Lounges, and Priority Pass Lounges

- Over $1,400 in annual credits which includes airline incidentals, Uber Cash, digital entertainment, Fine Hotels + Resorts and The Hotel Collection, and more

- Enjoy complimentary Marriott Bonvoy Gold Elite status and Hilton Honors Gold status (enrollment required)

- Terms Apply

- $695 annual fee (See Rates and Fees)

- Card Value & AMEX Platinum Points Calculator

- Earn 4X points at restaurants worldwide, on up to $50,000 in purchases per calendar year (then 1X)

- Earn 4X points at U.S. supermarkets, on up to $25,000 in purchases per calendar year (then 1X)

- Earn 3X points on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X points on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X points on all other purchases

- Receive up to $400+ in annual credits each year

- Terms Apply

- $325 annual fee (See Rates and Fees)

- Card Value & AMEX Gold Points Calculator

- Earn 5X points on flights and prepaid hotels on amextravel.com

- Earn 1.5X points (that’s an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more, on up to $2 million per Card Account per calendar year. Purchases eligible for multiple additional point bonuses will only receive the highest eligible bonus

- Earn 1X points on all other eligible purchases

- Global Airport Lounge Access including Centurion Lounges, Delta Sky Club Lounges (when flying Delta), Airspace Lounges, Escape Lounges, and Priority Pass Lounges. Access is limited to eligible Card Members.

- Unlock over $2,000 in statement credits with business and travel benefits annually (after meeting qualifying spend thresholds) on the Business Platinum Card.

- NEW! Make the Business Platinum Card® work even harder for you. Hilton For Business members get up to $200 back per calendar year when you make an eligible purchase at Hilton properties across the globe. Benefit enrollment required.

- Enroll in complimentary Marriott Bonvoy Gold Elite status and Hilton Honors Gold status

- Terms Apply

- $695 annual fee (See Rates and Fees)

- Card Value & Business Platinum Points Calculator

- Earn 4X points on the 2 select categories where your business spent the most each billing cycle, on up to $150,000 per year (then 1X)

- Earn 3X points on flights and prepaid hotels booked on AmexTravel.com

- Earn 1X points on all other purchases

- Terms Apply

- $375 annual fee (See Rates and Fees)

- Card Value & Rewards Calculator

- Earn 2X points on the first $50,000 in purchases per year, then 1 point per dollar thereafter

- Terms Apply

- $0 annual fee (See Rates and Fees)

- Card Value & Rewards Calculator

We've run the calculations and checked them twice — here are the credit cards that consistently provide outstanding value to our users:

- Best flexible travel card: Capital One Venture Rewards Credit Card

- Best for high cash back: Blue Cash Preferred® Card from American Express

- Best for foodies: American Express® Gold Card

- Best for business travel rewards: Ink Business Preferred® Credit Card

- Best for heavy business spenders: Capital One Spark Cash Plus

AMEX Membership Rewards Points Calculators & Guides

-

Calculator: AMEX Points To Miles & Hotels

View the list of AMEX transfer partners and calculate the transfer of AMEX points to airline and hotel rewards programs. -

AMEX Membership Rewards Points Value Calculator

Get the details on what you can redeem AMEX points for and find out which redemptions will give you the most value. -

Calculator: AMEX Points to Amazon Cash Value

Get the details on redeeming Membership Rewards points at checkout on Amazon.com and calculate the average value. -

Calculator: Rakuten Cash Back vs AMEX Membership Rewards

Have a Membership Rewards credit card? Earn bonus AMEX points shopping online with thousands of retailers using Raktuten Rewards. -

Calculator: The Platinum Card® from American Express

View the card benefits and calculate total AMEX Platinum points and card value based on your spend. -

Calculator: American Express® Gold Card

View the card benefits and calculate total AMEX Gold points and card value based on your spend. -

Calculator: American Express® Green Card

View the card benefits and calculate total AMEX Green points and card value based on your spend. -

Calculator: The Business Platinum Card® from American Express

View the card benefits and calculate total Business Platinum points and card value based on your spend. -

Calculator: American Express® Business Gold Card

View the card benefits and calculate total Business Gold points and card value based on your spend. -

Calculator: Business Green Rewards Card from American Express

View the card benefits and calculate total Business Green points and card value based on your spend. -

Calculator: The Blue Business® Plus Credit Card from American Express

View the card benefits and calculate total Blue Business Plus points and card value based on your spend.