Accor Hotels Points Value Calculator

Quick Overview

- Accor points can be redeemed for free nights at Accor hotels, OneFineStay gift cards, select restaurants and bars, experiences, and can be transferred to airline partners.

- The best Accor points value comes from redeeming them for free nights at Accor hotels, with a set value of €0.02 (around 2.2 cents USD) per point.

- Accor points can also be converted to airline miles and more, typically at a 2:1 rate, where 2,000 Accor points equal 1,000 miles—useful if you’re just short of a redemption.

Use our Accor Points Calculator to determine the average value of your Accor points when redeemed for free nights and more.

Accor points value

Every 2,000 Accor points redeemed towards free nights at Accor brand hotels is equal to 40 Euros. At time of this article, this is equal to about US $44 meaning that Accor points are worth about 2.2 cents.

Here's our breakdown of Accor points value:

| Redemption options | Accor points value |

|---|---|

| Free nights | 2.2 cents |

| Transfers to partners | 0.5 cents - 1 cent |

Redeeming Accor points for free nights

Redeeming your Accor points for free nights will give your points a value of €0.02 per point which is equal to 2.2 cents USD. Points can be redeemed in 2,000-point increments, so every 2,000 Accor points you redeem towards your stay will be worth €40 (about US$44).

If you're staying at an Accor Hotel in Europe in which the currency is in Euros, this is a relatively simple redemption.

If you're staying at an Accor Hotel in which the currency is not in Euros, you'll be at the mercy of the local currency exchange rate. This will not make a big difference in value, but it's something you'll want to be aware of.

Another good thing about using your Accor points for stays is that your points will be refunded if you cancel your booking prior to your stay. This is not something that many rewards programs allow.

Usually booking with rewards is final or have penalties under most conditions, so this is a nice benefit.

OneFineStay gift cards

Outside of staying at Accor brand hotels, you can also use Accor points towards stays at luxury private homes and villas through OneFineStay.

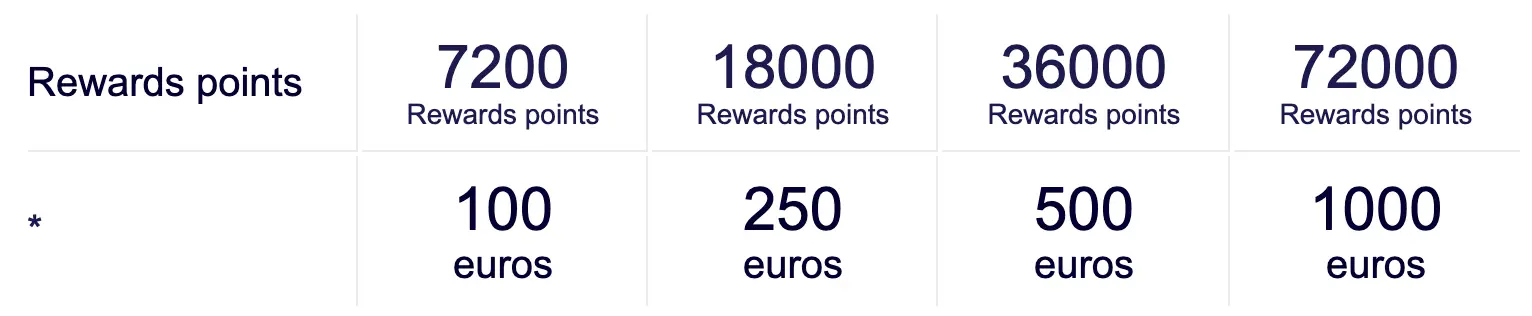

Redemptions for OneFineStay will be in the form of a OneFineStay gift card which will give your points a value of €0.0138 each (about US 1.5 cents each). Redemptions for OneFineStay starts at 7,200 Accor points for a €100 gift card.

Dining out

Accor points can be used a participating restaurants and bars around the world for a value of €0.01 per point (about 1.1 cents each USD). You can apply Accor points to your bill using the Accor All app.

Every 1,000 Accor points you use will give you a €10 credit towards your bill. If you don't have enough points to settle the full amount, you can still earn rewards points using the app at the rate of 1 Accor Point per €1 spent.

Transferring Accor points to partners

Accor points can be transferred to more than 30 transfer partners which consists of airlines and transportation partners. Most transfers are at a 2:1 ratio which allows you to transfer 4,000 Accor points for 2,000 miles/points with their partners.

This can be a useful route to take if you need to top off an airline or transportation account due to being a few points shy of travel. With the right transfers, you can also get decent value out of some redemptions though redeem points for free nights will still be the best option overall.

Accor Limitless Experiences

Accor points can be used towards experiences and merchandise through the Accor Limitless Experiences Portal. This includes sports events, concerts, tours, and everything in between.

Accor points value calculator

Use the Accor points Value Calculator to calculate the average value of Accor points based on redemption. This will give you an idea of how much your Accor points are worth on average.

Do note that values for Accor redemptions are in USD.

Calculator: How much are your Accor points worth?

| Redemption | Average Dollar Value |

|---|---|

| Accor Hotel Properties | ~$0 |

| OneFineStay | ~$0 |

| Dining Out | ~$0 |

| Merchandise | ~$0 - $0 |

Accor redemption value calculator

Use our Accor redemption value calculator to calculate Accor points to cash value for a redemption based on the cost in cash versus the cost in Accor points. This tool is useful when trying to decide whether to use cash or points when redeeming for hotels, experiences, and other options.

How does Accor points value compare?

Here's how the value of Accor points compare against rewards earned with other hotel brands:

Best U.S. credit cards for Accor Hotels

The best travel card for earning Accor points in the U.S. will be a Capital One Travel credit card, Bilt Rewards credit card, or a Citi ThankYou Rewards credit card. Rewards earned in both programs can be converted into Accor points.

Capital One Rewards

Capital One Venture miles and Spark miles can be converted into Accor points at a 1:1 rate. This means every 1,000 Capital One miles you transfer to your account will give you 1,000 Accor points.

Capital One is fantastic for earning a flat-rate of rewards across all purchases. This makes the program a great option if you're look to run spend through one primary credit card.

Another big plus is that all Capital One Travel cards have no foreign transaction fee which means you will not be penalized when making international purchases. This is great if you frequent Accor hotels since they are mostly located outside of the US.

Here are the travel cards that Capital One offers:

- Earn 10X Miles on hotels and rental cars booked through Capital One Travel

- Earn 5X Miles on flights and vacation rentals booked through Capital One Travel

- Earn an unlimited 2X Miles on all other purchases

- Receive a $300 annual credit for bookings through Capital One Travel

- 10,000 bonus miles annually starting on your first anniversary (worth $100 towards travel)

- Access to Capital One Lounges and Priority Pass Lounges

- Up to $120 towards a Global Entry or TSA Precheck application fee

- $395 annual fee

- Card Value & Venture X Miles Calculator

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Earn an unlimited 2X miles on all other purchases

- Two complimentary lounge visits per year to Capital One Lounges or Plaza Premium Lounges

- Up to $120 towards a Global Entry or TSA Precheck application fee

- $95 annual fee

- Card Value & Venture Miles Calculator

- Earn 5X miles on hotels and rental cars booked through Capital One Travel

- Earn an unlimited 1.25X miles on all other purchases

- No annual fee

- Card Value & VentureOne Miles Calculator

- Earn 10X Miles on hotels and rental cars booked through Capital One's travel booking site

- Earn 5X Miles on flights and vacation rentals booked through Capital One's travel booking site

- Earn an unlimited 2X Miles on all other purchases

- Receive a $300 annual credit for bookings through Capital One's travel booking site

- 10,000 bonus miles annually starting on your first anniversary (worth $100 towards travel)

- Access to Capital One Lounges and Priority Pass Lounges

- Up to $120 towards a Global Entry or TSA Precheck application fee

- $395 annual fee

- Card Value & Venture X Business Miles Calculator

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One's travel booking site

- Earn unlimited 2X miles on every card purchase

- Up to $120 towards a Global Entry or TSA Precheck application fee

- $0 the first year, then $95

- Card Value & Spark Miles Calculator

- Earn 5X miles on hotels and rental cars booked through Capital One's travel booking site

- Earn unlimited 1.5X miles on every card purchase

- No annual fee

- Card Value & Rewards Calculator

Bilt Rewards

Bilt Rewards points can be converted into Accor Hotels points at a 3:2 rate. This means every 3,000 Bilt Rewards points you transfer will give you 2,000 Accor Hotel points.

Bilt is most known for being able to pay your rent and mortgage using the Bilt Mastercard with no transaction fee allowing you to earn a large amount of points on what is normally a large purchases for most individuals. On top of that, Bilt makes it easy to earn additional points with their many promos and bonuses for shopping locally.

Here is the credit card Bilt offers:

- Earn 3X points on dining.

- Earn 2X points on travel.

- Earn 1X points on rent payments, up to 100,000 points per year.

- Earn 1X points on all other purchases.

- Enjoy cell phone coverage and travel coverage including trip cancellation and interruption insurance.

- No annual fee and no foreign transaction fees.

- Card Value & Bilt Points Calculator

Citi ThankYou Rewards

Citi ThankYou Rewards points can be converted into Accor points at a 1:1 ratio if you have the Citi Strata Premier℠ Card. This means every 1,000 ThankYou points you convert will give you 1,000 Accor points.

Citi offers a handful of ThankYou Rewards credit cards that earns ThankYou Rewards points and points can be moved between them. Just make sure that you have the Citi Strata Premier Card if you wish to transfer to Accor and the rest of Citi's hotel and airline partners.

Here are the ThankYou Rewards credit cards that Citi offers:

- Earn 10X points on hotels, car rentals and attractions booked through Citi Travel℠

- Earn an unlimited 3X points on restaurant, supermarket, gas station, hotel, air travel, and electric vehicle (EV) charging station purchases

- Earn 1X points on all other purchases

- Receive an annual $100 credit on any $500+ hotel stay booked through the ThankYou.com portal

- As a Citi Strata Premier cardholder, transfer ThankYou Points to all of Citi's airline and hotel partners

- $95 annual fee

- Card Value & Citi Premier Points Calculator

- Earn 2X points on the first $6,000 spent at supermarkets and gas stations per year, then 1X.

- Earn 1X points on all other purchases

- Purchases made to the card will be rounded up to the nearest 10

- Redeeming your ThankYou Points will earn you 10% of your points back into your account

- $0 annual fee

- Card Value & Rewards Calculator

- Earn 2% on every purchase with unlimited 1% back when you buy, plus an additional 1% as you pay for those purchases

- No annual fee

- Card Value & Rewards Calculator

- Earn 5% back on your top eligible spend category each billing cycle, on up to the first $500 spent (then 1%)

- Earn an unlimited 1% back on all other purchases

- No annual fee

- Card Value & Rewards Calculator

We've run the calculations and checked them twice — here are the credit cards that consistently provide outstanding value to our users:

- Best flexible travel card: Capital One Venture Rewards Credit Card

- Best for high cash back: Blue Cash Preferred® Card from American Express

- Best for foodies: American Express® Gold Card

- Best for business travel rewards: Ink Business Preferred® Credit Card

- Best for heavy business spenders: Capital One Spark Cash Plus

Accor Hotel Points Calculators & Guides

-

Which Credit Card Points Transfer To Accor?

View the list of Accor credit card transfer partners and find out which cards will earn you the most points. -

Accor Hotels Points Value Calculator

Find out how much Accor points are worth on average when redeemed for free nights and more and calculate their average value. -

Transferring Rewards To and From Accor ALL

View the list of Accor transfer partners and calculate the transfer of rewards to and from the Accor ALL program.