Calculator: Best Western Points Earned Per Stay

Quick Overview

- Best Western members can earn up to 25 points per $1 spent at Best Western hotels, combining base points, elite status bonuses, and co-branded credit card points.

- Members earn 10 base points per $1 spent at all Best Western hotels.

- Elite status bonus points vary by tier: 10% for Gold, 15% for Platinum, 30% for Diamond, and 50% for Diamond Select. Blue members do not receive a bonus.

- Paying with a Best Western credit card can add up to 10 additional points per $1 spent.

- Base and elite points post shortly after your stay, while credit card points typically post after the billing cycle ends.

Use our Best Western Points Earned Per Stay Calculator to estimate how many points you can earn on your next stay.

How Best Western base points are calculated

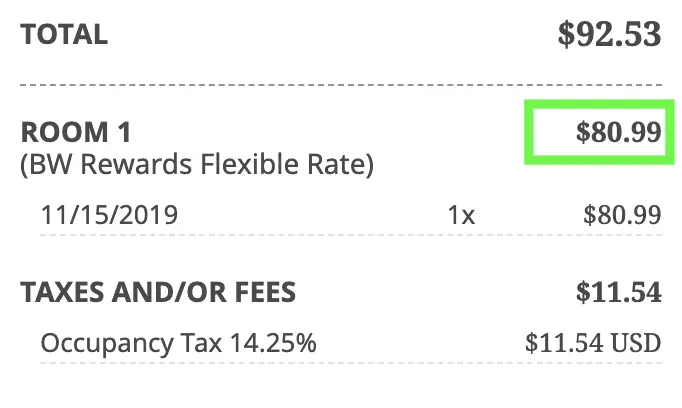

Best Western members earn 10 points per $1 spent on the base price of the hotel. This will be the cost before taxes and fees are added.

So if the base cost of your hotel stay is $200, you would earn a total of 2,000 base points on the stay.

As per the usual with most hotels, you will only earn points on paid stays. Nights booked with Best Western Rewards Points will not earn you points.

How Best Western elite points are calculated

Best Western has five tiers in their rewards programs: Blue, Gold Elite, Platinum Elite, Diamond Elite, and Diamond Select Elite. Each tier offers a handful of great benefits including bonus points on the base rate which can earn you up to an additional 5 points per $1 spent.

| Level | Bonus | Points Earned |

|---|---|---|

| Blue Member | No Bonus | 0 |

| Gold Elite | 10% Bonus | 1 |

| Platinum Elite | 15% Bonus | 1.5 |

| Diamond Elite | 30% Bonus | 3 |

| Diamond Select Elite | 50% Bonus | 5 |

Points earned from obtaining Best Western elite status will stack on top of the base points earned for the stay.

For example, a Best Western Gold Elite member would earn a total of 2,200 points if the base cost of the hotel stay was $200. This would be 2,000 base points plus a 10% bonus on that base rate which would equal 200 points.

How Best Western credit card points are calculated

On top of your base points and elite status points, you can earn even more points using Best Western credit cards to pay for your stay. This can earn you up to an addtional 10 points per $1 spent.

When using a Best Western credit card to pay for your stay, you will earn Best Western Points on the entire cost of the stay including taxes/fees.

Points earned with credit cards will usually not post to your account immediately, but instead post to your account when the statement period ends. Points earned may also lag behind one statement (depends on the bank/program) so be sure to note that.

| Credit Card | Points Per $1 Spent |

|---|---|

| Best Western Rewards® Premium Visa Signature® Card | 10 |

| Best Western Rewards® Visa Signature® Card | 4 |

Taxes aside, a $200 stay at a Best Western Hotel as a Diamond Select Elite would earn you a total of 5,000 points. That's 2,000 base points, 1,000 points from the 50% elite status bonus, and 2,000 credit card points.

As a member with no elite status and no Best Western credit card, you would only earn 2,000 points total which is a big difference in value.

Calculate Best Western points per stay

Use the Best Western Point Calculator to estimate how many Best Western Points you can earn per stay based on brand, status, and Best Western credit cards.

We've run the calculations and checked them twice — here are the credit cards that consistently provide outstanding value to our users:

- Best flexible travel card: Capital One Venture Rewards Credit Card

- Best for high cash back: Blue Cash Preferred® Card from American Express

- Best for foodies: American Express® Gold Card

- Best for business travel rewards: Ink Business Preferred® Credit Card

- Best for heavy business spenders: Capital One Spark Cash Plus

Best Western Points Calculators & Guides

-

Best Western Points Value Calculator

Find out how much Best Western points are worth when redeemed for free nights, gift cards and more, and calculate the average value. -

Best Western Point Transfers To Partners

View the list of Best Western transfer partners and calculate the conversion of Best Western points into airline miles and other rewards. -

Calculator: Best Western Points Earned Per Stay

Find out how Best Western points are calculated and calculate how many you can earn on your next stay. -

Calculator: Best Western Rewards® Premium Visa Signature® Card

Review the card benefits and calculate Best Western points and card value based on your spend. -

Calculator: Best Western Rewards® Visa Signature® Card

Review the card benefits and calculate Best Western points and card value based on your spend.