MyLowe's Rewards: Program & Rewards Overview

Quick Overview

- Free to Join: MyLowe's Rewards is Lowe's free loyalty program, offering exclusive perks and savings.

- Member Benefits: Enjoy member gifts, exclusive offers, free standard shipping, and earn points redeemable for discounts on Lowe’s purchases.

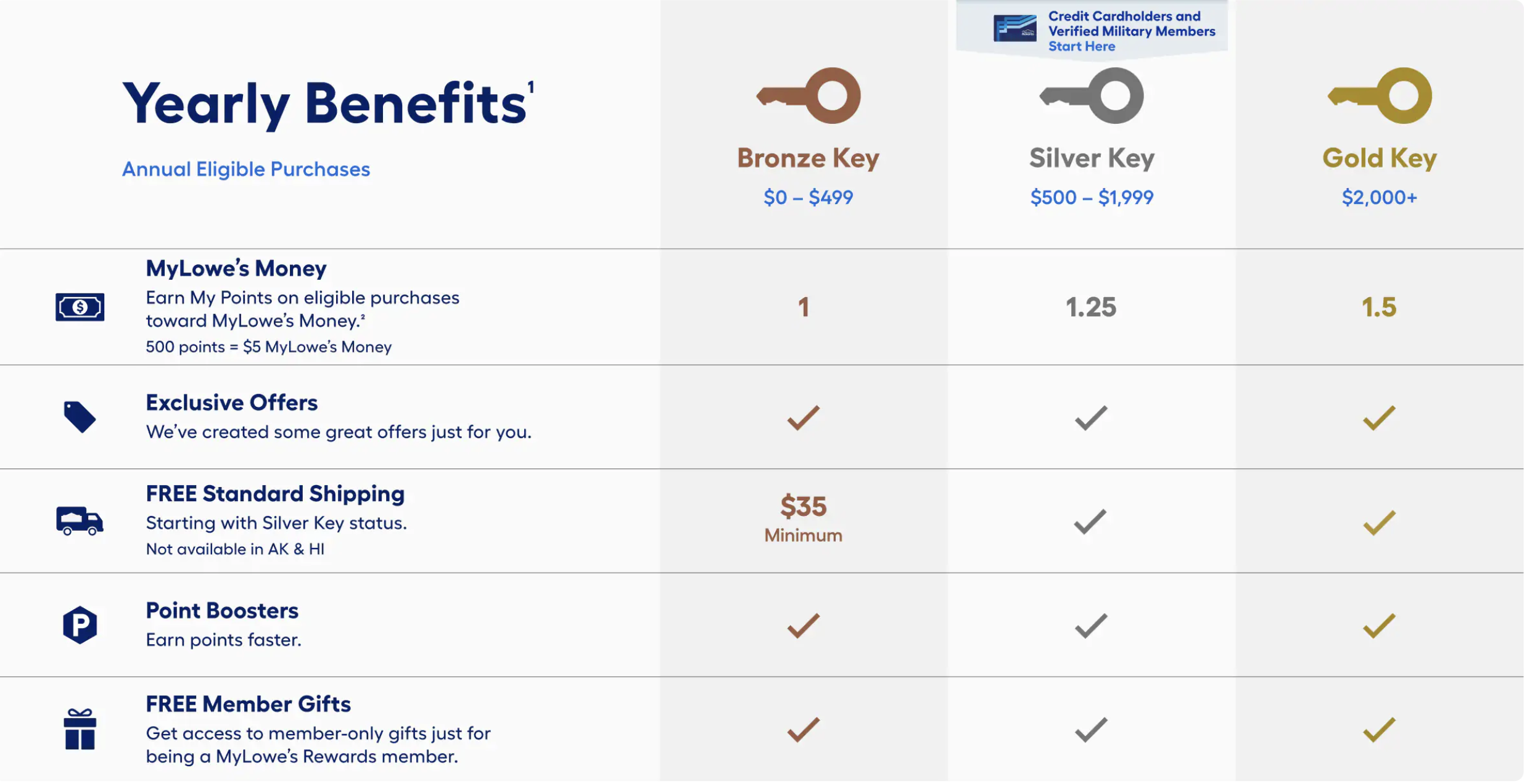

- Membership Tiers: The program features three levels based on annual spending:

- Bronze Key: Entry-level membership.

- Silver Key: Unlocks at $500 annual spend.

- Gold Key: Achieved with $2,000 annual spend.

- Points Value: Points are worth 1 cent each—earn 500 points to receive $5 in MyLowe’s Money, usable in-store or online.

- Credit Card Perks: The MyLowe's Rewards credit card lets you earn My Points on purchases, plus enjoy 5% off everyday purchases or special financing options.

MyLowe's Rewards benefits

The MyLowe's rewards program features a handful of benefits. This includes:

- The ability to earn Lowe's points which can be converted to MyLowe's Money redeemable towards Lowe's purchases

- Free standard shipping once you've reached Silver Key status

- Member-only gifts for being a MyLowe's rewards member

- Access to exclusive offers

These are all pretty solid benefits considering that the program is free to sign up for.

If you apply for the MyLowe’s Rewards Credit Card, you'll gain even more benefits on top of the one's that come with being a MyLowe's Rewards member. This includes:

- Save 5% everyday on Lowe's purchases or opt for 6 months special financing on purchases of over $299

- Automatic Silver Key status which normally requires spending $500 with Lowe's

- A higher earning rate of 1.25X points per $1 spent thanks to the Silver Key status

MyLowe's Membership Levels

There are three levels of MyLowe's Rewards membership: Bronze, Silver, and Gold. Status in each program is based on annual purchases made in-store and online with Lowe's.

Here is the quick breakdown on each level:

Bronze Key Status

When you sign up for a free MyLowe's account, you will start at Bronze Key status. Here are the benefits of Bronze:

- Earn 1 My Point per $1 spent on eligible Lowe's purchases

- Receive exclusive offers tailored to you

- Free standard shipping on minimum purchases of at least $35

- Point boosters which can help you earn points on select purchases faster

- Free member gifts just for being a member

Silver Key Status

MyLowe's Rewards Silver Key status requires you to spend at least $500 annually with Lowe's. You can also obtain Silver Key status automatically by either picking up the MyLowe’s Rewards Credit Card or being a verified military member.

Silver Key offers a higher rate of 1.25 points per $1 spent on Lowe's purchases — a 25% increase over Bronze status. You'll also receive free shipping with no minimum purchase amount.

All other benefits remain the same.

Gold Key Status

MyLowe's Rewards Gold Key status requires you to spend at least $2,000 annually with Lowe's. If you frequent Lowe's or finance home projects through them, it's not a hard goal to hit.

The only benefit of Gold Key status is the higher point earning rate of 1.5 points per $1 spent — a 50% boost over the starting Bronze Key level. This is equal to a 1.5% return on your Lowe's purchases which is pretty solid for a free program.

Earning MyLowe's Rewards points

MyLowe's Rewards points are earned spending in-store and online with Lowe's as a MyLowe's Rewards member. You'll earn points based on your status in the program.

- Bronze Key: 1 My Point per $1 spent

- Silver Key: 1.25 My Points per $1 spent

- Gold Key: 1.5 My Points per $1 spent

This is equal to a 1%, 1.25%, and 1.5% return on eligible purchases, respectively.

In order to earn points, you must scan your MyLowe's ID, use Wallet Scan, or provide the phone number associated with your MyLowe's account at checkout. If you're using the Lowe's app, you'll need to be signed into your account.

Do note that My Points will expire 12 months after the last points-earning activity. So you'll want to make sure to make at least one purchase at Lowe's per year to keep your points.

How many My Points will you earn?

Want to know how many My Points you will earn based on your status in the MyLowe's Rewards program? Enter any amount of spend below to find out.

Do note that if you have the MyLowe's Rewards Credit Card, you will also earn 5% back on your eligible everyday Lowe's purchases (if you don't opt in for financing).

| Status | Total My Points |

|---|---|

| Bronze Key | 0 My Points |

| Silver Key | 0 My Points |

| Gold Key | 0 My Points |

| Cardholders Also Save 5% Everyday | $0 in Everyday Savings |

MyLowe's Rewards points value

How much are MyLowe's Rewards points worth? The Answer: 1 cent per point.

Every 500 My Points you earn will be converted into a $5 worth of MyLowe's Money. MyLowe's Money is worth face value and can be redeemed in-store, via the Lowe's mobile app, and on Lowes.com.

| Redemption options | Redemption point value (in cents) |

|---|---|

| MyLowe's Rewards My Points | 1 |

Calculator: Convert My Points to dollar value

Use our MyLowe's Rewards points value calculator to convert My Points into MyLowe's Money.

| Redemption | Average Dollar Value |

|---|---|

| # of $5 MyLowe's Money Certificates | 0 Certificates |

| Value of points | $0 |

Lowe's Rewards credit cards

The MyLowe's Rewards program features one primary credit card and that is the MyLowe’s Rewards Credit Card.

If you shop at Lowe's, even if only a few times per year, the 5% off you'll get on everyday Lowe's purchases is worth picking up the card — especially since it has no annual fee. Just be sure to pay the card off entirely to avoid interest otherwise the 5% will not be worth it as it will be consumed by the high interest rates.

Another big plus of the Lowe's card is the special financing you can opt-in for in lieu of earning 5% back. Here are the qualifications for special financing:

- 6 months special financing - Purchases of over $299

- 84 fixed monthly payments with reduced APR - Purchases of over $2,000

If you have a purchase to large project you want to finance, the special financing would be the route to take.

- 5% off every day or 6 months Special Financing on qualifying purchases of $299+ or 84 fixed monthly payments with reduced APR on qualifying purchases of $2,000+

- FREE Silver Key status in the MyLowe’s Rewards loyalty program

- 1.25 My Points per $1 spent with Silver Key status.

- Exclusive cardholder events

- No annual fee

- Card Value & Rewards Calculator

Other credit card options

When it comes to earning rewards on your everyday Lowe's purchases, it will not get any better than picking up the MyLowe's Rewards Credit Card as you just can't beat an instant 5% back.

On the financing side, the best option will still typically be the MyLowe's Rewards credit cards as it's an easy way to keep everything to one card and you can easily finance your purchase with little effort as long as you've met the spend requirements.

If you're looking for an alternative, Upgrade offers a handful of credit cards that combine the flexibility of a cash back rewards credit card with the predictability of a personal loan.

They offer credit lines of up to $25,000 and can earn you anywhere from 1.5% to 3% back on your day-to-day purchases depending on which card you have. They also have a pre-approval option for all of their cards, so you can see if you have an offer with no impact to your credit score.

The details on Upgrade's credit cards are listed below. You can click on any of the card to learn more directly through Upgrade's website or use our rewards calculator to calculate how much you can earn.

- Earn 3% cash back on home, auto, and health purchases

- Earn 1% cash back on all other purchases

- Credit lines from $500 to $25,000

- Earn unlimited cash back everyday on every purchase when you pay it back

- Swipe, tap, insert or purchase online anywhere Visa is accepted

- Pay down balances from each month at a fixed rate and term and set payoffs so you can bring your balance down faster so you can pay less interest

- $0 annual fee

- Card Value & Rewards Calculator

- Earn unlimited 1.5% cash back on all purchases.

- Get a credit line from $500 to $25,000.

- Earn unlimited cash back everyday on every purchase when you pay it back

- Swipe, tap, insert or purchase online anywhere Visa is accepted

- Pay down balances from each month at a fixed rate and term

- Set payoffs so you can bring your balance down faster so you can pay less interest

- $0 annual fee

- Card Value & Rewards Calculator

Other Upgrade credit cards:

We've run the calculations and checked them twice — here are the credit cards that consistently provide outstanding value to our users:

- Best flexible travel card: Capital One Venture Rewards Credit Card

- Best for high cash back: Blue Cash Preferred® Card from American Express

- Best for foodies: American Express® Gold Card

- Best for business travel rewards: Ink Business Preferred® Credit Card

- Best for heavy business spenders: Capital One Spark Cash Plus

MyLowe's Rewards Calculators & Guides

-

MyLowe's Rewards: Program & Rewards Overview

View the details on the MyLowe's Rewards program and find out if it's worth signing up for. -

Calculator: MyLowes's Rewards Credit Card

Calculate total earnings and compare side-by-side top rewards credit cards based on your spend. -

How To Earn Bonus Cash Back Using Online Shopping Portal

Get the scoop on how to use shopping portals to double and triple-dip on rewards... for free!