Calculator: How Many Hyatt Points Do You Earn Per Stay?

Quick Overview

- World of Hyatt members can earn up to 10.5 Hyatt points per $1 spent at Hyatt hotels, combining base points, elite status points, and points from a Hyatt credit card.

- Members earn 5 base points per $1 spent at all Hyatt properties.

- Elite status bonus points vary by tier: 10% for Discoverist, 20% for Explorist, and 30% for Globalist, while basic members earn no bonus.

- Paying with a Hyatt credit card adds an extra 4 points per $1 spent.

- Base and elite points post after your stay, while credit card points post after each billing cycle.

Use our Hyatt Points Calculator to estimate how many points you’ll earn on your next Hyatt stay, factoring in spend, elite status, and whether you pay with a Hyatt co-branded card.

How Hyatt base points are calculated

World of Hyatt members earn 5 Hyatt points per $1 spent on the base rate at participating hotels.

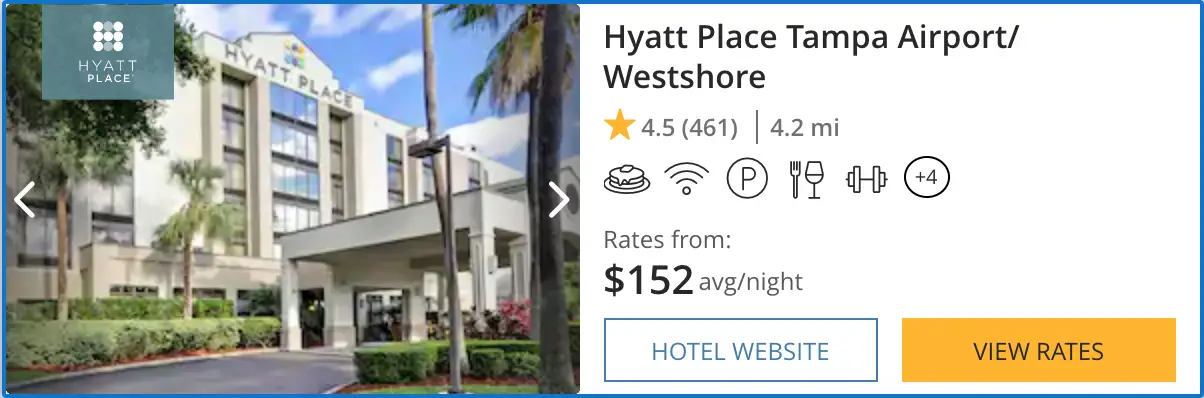

So a hotel that costs you $152 per night would earn you 760 Hyatt Points per night. Base points are not earned on the taxes and fees portion of your bill.

How Hyatt elite status points are calculated

You can earn elite status with Hyatt by staying at Hyatt brand hotels during the calendar year. You can qualify for elite status with Hyatt based on either nights or base points earned.

For example, you can earn Hyatt Discoverist status by staying 10 nights at Hyatt properties during the calendar year or you can earn Hyatt Discoverist status by earning 25,000 base points during the calendar year.

Based on your status within the World of Hyatt program, you'll earn a certain percentage of bonus points per $1 spent which is based on the base rate. The table below breaks down the Hyatt Elite Status requirements.

| Level | Bonus | Points Earned |

|---|---|---|

| Member | No Bonus | 0 |

| Discoverist | 10% | 0.5 |

| Explorist | 20% | 1 |

| Globalist | 30% | 1.5 |

Bonus points earned from Hyatt Elite status are in addition to the points that you earn at the base rate. So if the base cost of your stay costs $152 and you're a Hyatt Explorist, you'll earn 760 base points plus an additional 152 points from the 20% bonus for a total of 912 Hyatt points.

How Hyatt credit card points are calculated

Using Hyatt credit cards to pay for you stay will earn you 4 additional Hyatt Points per $1 spent. Unlike base points and elite status points, Hyatt credit cards will earn you points on the full cost of the stay including taxes and fees.

Taxes aside, a $152 stay as a Hyatt Explorist using a Hyatt credit card to pay for the stay will earn you 760 base points, 152 elite status points, and 608 credit card points for a total of 1,520 points.

Since taxes and fees are included, you'll actually earn slightly more than that due to earning points on the taxes and fees using a Hyatt credit card.

Hyatt offers two credit cards that will earn you Hyatt points per $1 spent at Hyatt brand hotels. Here are those cards:

- Earn 4 Bonus Points per $1 spent at Hyatt hotels

- Earn 2 Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airlines, on local transit and commuting and on fitness club and gym memberships

- Earn 1 Bonus Point per $1 spent on all other purchases

- Receive an Annual Free Night Award good for a stay at a Category 1-4 Hyatt hotel or resort and earn a second Free Night Award every year that you spend $15,000 or more on the card

- Receive complimentary Hyatt Discoverist Status as long as you're a Chase Hyatt Credit Card holder

- Receive 5 Qualifying Nights towards Hyatt Elite Status every year and earn 2 additional Qualifying Nights for every $5,000 you run through the card.

- $95 annual fee

- Card Value & Hyatt Points Calculator

- Earn 4 Bonus Points per $1 spent on qualifying purchases at Hyatt Hotels. Plus, up to 5 Base points from Hyatt per eligible $1 spent just for being a World of Hyatt member

- Earn 2 Bonus Points per $1 spent in your top three spend categories each quarter

- Earn 2 Bonus Points per $1 spent on fitness club and gym memberships

- Earn 1 Bonus Point per $1 spent on all other purchases

- Get up to $100 in Hyatt statement credits when you spend $50 or more at any Hyatt property and earn $50 statement credits up to two times each anniversary year

- Receive complimentary Hyatt Discoverist Status as long as you're a Chase Hyatt Business Card holder

- For every $10,000 spent on the card, you'll earn 5 annual Qualifying Nights towards reaching top-tier elite status with Hyatt

- After spending $50,000 on the card, you'll get 10% of your redeemed points back for the rest of the calendar year

- $199 annual fee

- Card Value & Rewards Calculator

Hyatt points per stay calculator

Use our Hyatt Point Calculator to estimate how many Hyatt Points you can earn per dollar spent on stays based on hotel cost, status, and Hyatt credit cards.

We've run the calculations and checked them twice — here are the credit cards that consistently provide outstanding value to our users:

- Best flexible travel card: Capital One Venture Rewards Credit Card

- Best for high cash back: Blue Cash Preferred® Card from American Express

- Best for foodies: American Express® Gold Card

- Best for business travel rewards: Ink Business Preferred® Credit Card

- Best for heavy business spenders: Capital One Spark Cash Plus

Hyatt Points Calculators & Guides

-

Which Credit Card Points Transfer To Hyatt?

View the list of Hyatt credit card transfer partners and find out which cards will earn you the most points. -

Transferring Rewards To and From World of Hyatt

View the list of Hyatt transfer partners and calculate the transfer of rewards to and from the World of Hyatt program. -

Hyatt Points Value Calculator

Use our Hyatt Points Value Calculator to convert Hyatt points to dollars for free nights, car rentals, gift cards, point transfers, and more. -

Calculator: How Many Hyatt Points Do You Earn Per Stay?

Get the scoop on how Hyatt points are calculated and find out how many you can earn on your next stay. -

Calculator: How Much Will It Cost To Buy Hyatt Points?

Want to buy Hyatt points but not sure if it's worth it? Use our calculator to determine the cost and see if it's a good deal for you. -

Calculator: World of Hyatt Card

Review the card benefits and calculate total Hyatt points and card value based on spend. -

Calculator: World of Hyatt Business Credit Card

Review the card benefits and calculate total Hyatt points and card value based on spend.