List of Business Rewards Credit Cards

- Travel Rewards Business Cards

- Cash Back Business Cards

- Airline Business Cards

- Hotel Business Cards

- Other Business Cards

Quick Overview

- Earn Rewards on Business Expenses: Accumulate points, miles, or cash back on purchases, helping to offset operational costs.

- Streamline Bookkeeping: Detailed statements make it easy to track and separate business and personal expenses for simpler accounting.

- Enhance Cash Flow Flexibility: Provides short-term financing for purchases, helping to manage cash flow during business cycles.

- Access Valuable Perks: Many cards include travel insurance, purchase protection, and discounts on services essential for business operations.

- Empower Employees with Control: Issue employee cards with customizable spending limits, earning rewards on their purchases while offering perks.

Travel Rewards Business Cards

Business travel rewards credit cards are an excellent choice for companies seeking to offset travel expenses while earning valuable rewards. These cards allow businesses to accumulate points or miles that can be redeemed towards purchases like airfare, hotel stays, car rentals, and other travel-related costs, helping to reduce overall travel budgets and make business trips more cost-effective.

American Express Business Travel Cards

American Express offers four business travel rewards credit cards that earn Membership Rewards® points, providing exceptional value for businesses. These points can be redeemed at a rate of 1 cent per point for airfare booked through Amex Travel, or transferred to Amex’s extensive network of airline and hotel partners for potentially higher redemption values—often exceeding 2 cents per point.

Additionally, Amex offers powerful earning potential on everyday business purchases. By pairing the 4X Membership Rewards® points on select categories from the American Express® Business Gold Card with The Blue Business® Plus Credit Card, which earns 2X points on all purchases up to a spending cap, businesses can maximize their rewards on every transaction.

- Calculator: The Business Platinum Card® from American Express

- Calculator: American Express® Business Gold Card

- Calculator: The Blue Business® Plus Credit Card from American Express

- Calculator: Business Green Rewards Card from American Express

Chase Business Travel Cards

Chase offers one business rewards credit card and that is the Ink Business Preferred® Credit Card. It earns 3X Ultimate Rewards points on the first $150,000 spent on travel and select business categories each account anniversary year.

Points can be redeemed at a value of 1.25 cents each towards travel booked through Chase Travel℠ or be transferred to Chase's airline and hotel partners for increased value.

Chase's cash back credit cards earn Ultimate Rewards points which can be redeemed for 1 cent each towards cash back and statement credits.

When paired with the Ink Business Preferred® Credit Card, these points can be transferred and redeemed for travel at an elevated rate of 1.25 cents per point through Chase Travel. Additionally, points can be transferred to Chase’s airline and hotel partners for even greater value.

This pairing allows businesses to maximize rewards, turning everyday purchases into more valuable travel benefits and stretching their rewards further.

Capital One Business Travel Cards

Capital One offers two business travel rewards credit cards that earn Spark miles. Spark miles can be redeemed at a value of 1 cent per point towards any kind of travel including airfare, hotels, car rentals, and even tolls and parking—making this one of the most flexible travel rewards.

In addition to that, miles can also be converted into airline miles and hotel rewards points with Capital One's travel partners which can give them up to 2 cents or more in value.

- Calculator: Capital One Spark Miles for Business Card

- Calculator: Capital One Spark Miles Select for Business Card

Bank of America Business Travel Cards

Bank of America offers a straightforward travel rewards credit card that earns 1.5X points per dollar on all purchases, with points redeemable at 1 cent each.

While this base earning rate is comparable to a standard 1.5% cash back card, the card becomes significantly more rewarding for Bank of America Preferred Rewards for Business members. Depending on your combined balances with Bank of America and Merrill, you can earn up to 75% more points—boosting your effective rewards rate to 2.62X on all purchases, uncapped.

This makes it a top choice for businesses with substantial investments, offering better returns than many 2% cash back cards.

Cash Back Business Cards

A cash back business credit card is ideal for businesses seeking ultimate flexibility with straightforward rewards. Cash back is simple to understand and redeem, offering immediate value without the need for complicated strategies or extensive research.

Every dollar earned in cash back translates directly into savings or reinvestment opportunities for your business, making it an easy and effective way to maximize rewards.

AMEX Cash Back Business Cards

American Express offers one cash back business card that earns 2% cash back on the first $50,000 in annual purchases (then 1%). It's a great option for any business that has expenses totaling less than that during the calendar year.

Chase Cash Back Business Cards

Chase's cash back credit cards earn Ultimate Rewards points that can be redeemed at a value of 1 cent per point towards cash back, statement credit, travel, and several other redemptions.

Points earned with these cards can be moved to the Ink Business Preferred or Chase's personal travel credit cards such as the Chase Sapphire Preferred® Card and Chase Sapphire Reserve® to be redeemed for significantly higher value towards travel (exception: does not include Ink Business Premier® Credit Card).

- Calculator: Ink Business Cash® Credit Card

- Calculator: Ink Business Unlimited® Credit Card

- No Calculator Available: Ink Business Premier® Credit Card

Capital One Cash Back Business Cards

Capital One offers three Spark business cash back credit cards, each designed to suit different levels of annual business spending. All three cards provide a straightforward, flat-rate cash back on every purchase, making them easy to use and highly rewarding.

- Capital One Spark Cash Plus: Ideal for businesses spending over $150,000 annually, maximizing rewards with unlimited 2% cash back, no preset spending limit, and a $150 annual fee reimbursement when spending $150K during the year.

- Capital One Spark Cash: Best for businesses with annual expenses between $30,000 and $150,000, offering 2% cash back with a manageable annual fee.

- Capital One Spark Cash Select: Perfect for businesses with expenses under $30,000 per year, featuring 1.5% cash back and no annual fee, providing value without added cost.

These options ensure businesses of all sizes can choose the card that aligns best with their spending habits.

- Calculator: Capital One Spark Cash Plus

- Calculator: Capital One Spark Cash

- Calculator: Capital One Spark Cash Select for Business

Other Cash Back Business Cards

Airline Business Cards

Airline business credit cards can be beneficial to any business looking for benefits when flying a specific airline. This includes free checked bags, priority boarding, discounts on in-flight purchases, and even complimentary lounge access.

The benefits on employee cards for co-branded airline credit cards vary with some offering little to no benefits outside with other offering complimentary lounge access and free checked bags. Regardless, all employee cards will earn miles on business expenses which can help push towards free travel faster.

Alaska Airlines Business Cards

Alaska only offers one business rewards credit card and their only major credit card partner is Bilt Rewards, which offers to business cards. So this is the best option if your business frequently flies Alaska.

Delta Airlines Business Cards

Delta offers three business credit cards to suit a variety of travel needs: Gold, Platinum, and Reserve.

- Gold: Ideal for businesses seeking essential travel perks like free checked bags and priority boarding.

- Platinum: A well-rounded choice, offering a valuable annual Main Cabin Companion Pass, plus benefits like earning Medallion® Qualification Miles (MQMs) to help you reach elite status faster.

- Reserve: Perfect for those who want premium benefits, including Delta SkyClub® access, complimentary upgrades, and an annual First Class Companion Certificate, making it the ultimate choice for frequent Delta travelers.

Each card is tailored to provide unique value, whether you're focused on travel savings or luxury experiences.

- Calculator: Delta SkyMiles® Gold Business American Express Card

- Calculator: Delta SkyMiles® Platinum Business American Express Card

- Calculator: Delta SkyMiles® Reserve Business American Express Card

The Business Platinum Card® from American Express offers complimentary access to Delta SkyClub® lounges, along with access to a wide network of lounges worldwide. Additionally, points earned with the card can be transferred to Delta SkyMiles at a 1:1 ratio, providing valuable flexibility for frequent Delta travelers.

It's possible that the Business Platinum Card could be the better option over the Reserve Card depending on what you're looking for.

Hawaiian Airlines Business Cards

Hawaiian Airlines offers one business credit card for earning HawaiianMiles on everyday expenses. Hawaiian is a direct 1:1 transfer partner of American Express Membership Rewards so you can use those business cards to boost your miles as well.

JetBlue Airways Business Cards

JetBlue offers a single business credit card, making it the top choice for maximizing rewards on JetBlue purchases. For other expenses, however, you may get more value by using partner business cards from American Express or Chase.

Since JetBlue is a direct transfer partner for both, you can easily boost your JetBlue points balance while earning more flexible rewards on everyday spending.

Southwest Airlines Business Cards

Southwest offers two business credit cards, both excellent choices for frequent business travelers seeking to maximize Rapid Rewards points.

Additionally, Chase Ultimate Rewards is a 1:1 transfer partner of Southwest Rapid Rewards, allowing you to use Chase business credit cards to easily boost your points balance and enjoy even more travel rewards.

- Calculator: Southwest Rapid Rewards® Performance Business Credit Card

- Calculator: Southwest Rapid Rewards® Premier Business Credit Card

United Airlines Business Cards

United offers two business credit cards, both designed to help you earn United miles through sign-up bonuses and everyday spending. The United Business Card is a solid choice for earning miles on a range of business purchases, while the United Club℠ Business Card is ideal for businesses seeking premium perks like United Club lounge access.

Additionally, United is a 1:1 transfer partner of Chase Ultimate Rewards, allowing you to use Chase business credit cards to further boost your United miles balance for more travel rewards and flexibility.

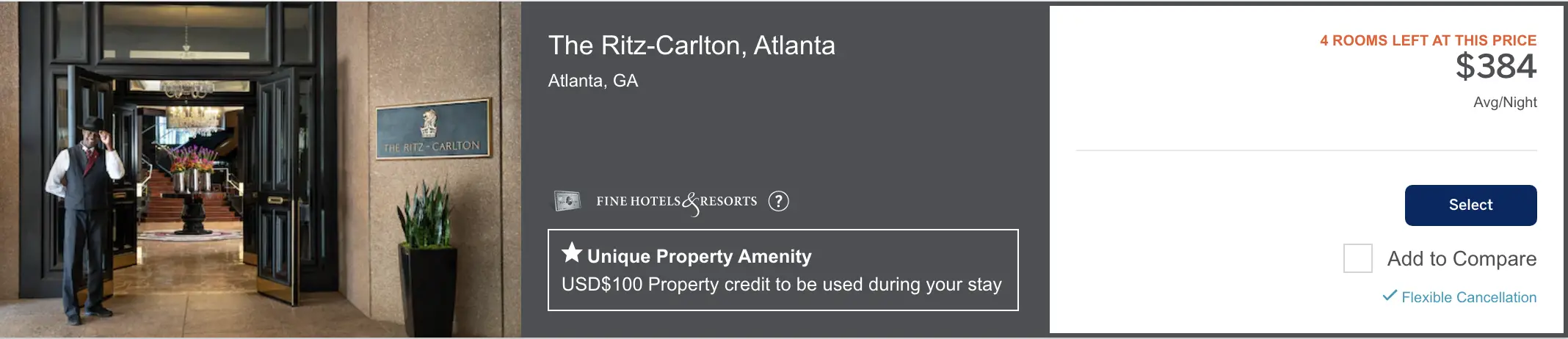

Hotel Business Cards

Hotel business credit cards are perfect for businesses seeking free nights and exclusive perks with specific hotel brands. These cards often include benefits like complimentary elite status, annual free night awards, and other travel-related advantages, making them a valuable tool for frequent business travelers looking to enhance their stays while saving on lodging costs.

Marriott Business Cards

Marriott offers a business credit card through American Express, perfect for earning points at Marriott properties and on everyday purchases. The card provides valuable perks, including an annual free night award, complimentary elite status, and elite night credits to help you achieve higher status levels.

Marriott is a 1:1 transfer partner of AMEX and Chase which means you can use their business cards to earn additional Marriott Bonvoy points.

Hilton Business Cards

Hilton offers one business credit card and it is one of the best co-branded credit cards available. It offers an excellent return on business expenses, complimentary elite status, and more.

AMEX points can be converted into Hilton Honors points 1:2 rate making AMEX's travel cards a great option for earning additional points on business expenses.

Hyatt Business Cards

Hyatt offers a co-branded business credit card through Chase, providing exceptional value for Hyatt business travelers. Known for offering some of the most valuable rewards in the industry, Hyatt points can be redeemed for highly rewarding stays and experiences.

Additionally, Hyatt is a direct transfer partner of Chase Ultimate Rewards®, allowing you to use Chase business credit cards to effortlessly boost your Hyatt points balance and maximize your travel rewards.

IHG Business Cards

IHG offers one co-branded credit card through Chase Bank which is the best option for IHG Travelers.

Wyndham Business Cards

The Wyndham Business Card is an excellent choice for frequent Wyndham travelers, offering top-tier elite status and earning an impressive 8X points on Wyndham purchases.

Additionally, Wyndham points can be boosted by transferring rewards from Capital One, making Capital One business cards another valuable option for maximizing rewards on Wyndham stays.

Other Business Cards

Credit Card Calculators By Category

-

American Express Credit Card Rewards Calculators

-

Bank of America Credit Cards Rewards Calculators

-

Capital One Credit Cards Rewards Calculators

-

Chase Credit Cards Rewards Calculators

-

Citibank Credit Cards Rewards Calculators

-

Travel Credit Cards Rewards Calculators

-

Cash Back Credit Cards Rewards Calculators

-

Airline Credit Cards Rewards Calculators

-

Hotel Credit Cards Rewards Calculators

-

Business Credit Cards Rewards Calculators